Yes Bank shares tumbled 10 percent on July 9 after reports suggested that Securities and Exchange Board of India (Sebi) may look into a large amount of share transaction of the bank under the Securities Lending and Borrowing Mechanism (SLBM).

On July 9, investors borrowed 95,99,987 shares worth Rs 5.9 crore for an interest rate of around Rs 7 per share. Investors borrowed these shares for a one-month period, with settlement due on August 6.

ED may file the complaint against 13 individuals and entities including Dewan Housing Finance Limited (DHFL) promoters Kapil and Dheeraj Wadhawan. Yes Bank had sanctioned a loan of Rs 750 crore to Belief Realtor Pvt. Ltd, a company controlled by the DHFL group. The loan was sanctioned on June 18, 2018, by the Management Credit Committee (MCC) headed by Rana Kapoor, who was then the MD and CEO of Yes Bank.

Capital Raising Committee (CRC) of the Board of Directors of the Yes Bank at its meeting on July 10 has approved the floor price at Rs 12 per equity share and cap price at Rs 13 per equity share. A meeting of the CRC will be be held on July 14 for the allocation of equity shares to successful anchor investors pursuant to the offer and for determination of the anchor investor allocation price.

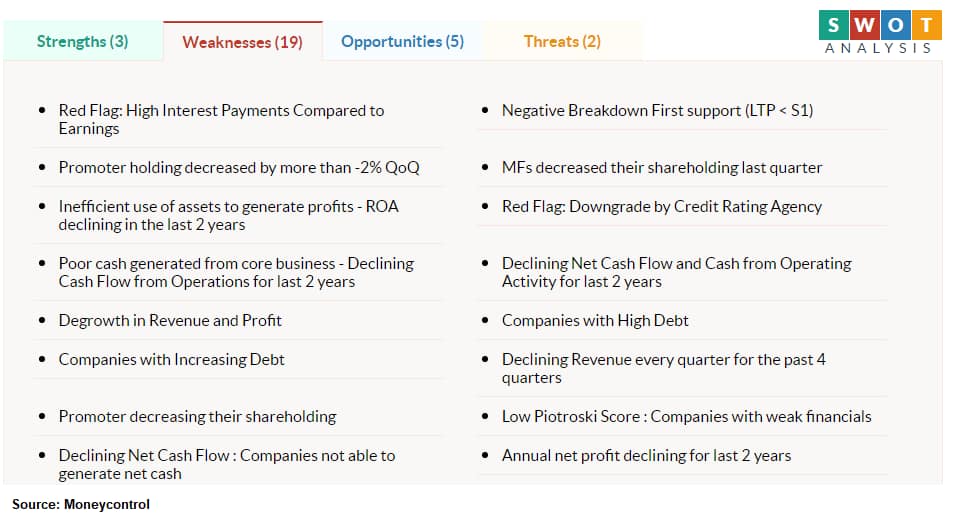

According to Moneycontrol SWOT Analysis powered by Trendlyne, Yes Bank has high debt with the company having high interest payments compared to earnings. MFs have also decreased their shareholding last quarter with the stock showing weak momentum - Price below short, medium and long term averages.

Moneycontrol technical rating is very bearish with moving averages and technical indicators being bearish.

Disclaimer: The views and investment tips expressed by experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!