The GST Council slashed rates on 178 items to 18 percent from 28 percent on Friday, which could benefit stocks under consumers, light electrical and home building.

The GST Council slashed taxes on all standalone restaurants to 5 percent, simplified return filing procedures for small firms in one of biggest changes in rules and rates since the new system kicked in from July 1.

The Goods and Services (GST) Council, which met in Guwahati for a 2-day meet starting Thursday of last week, has decided to keep only 50 luxury and 'sin' goods like tobacco in the highest slab.

The changes made to the GST Tax slabs will be applicable from 15th November 2017. The reduction in taxes is estimated to have an impact on government revenue to the tune of Rs 20,000 crore.

“The government has also ensured that the inflation in the country remains low and the revision of the tax slabs for a host of items can further improve the consumption in the country. We believe that this is a relief to the business community,” Vaibhav Agrawal, Head of Research & ARQ, Angel Broking Pvt Ltd told Moneycontrol.

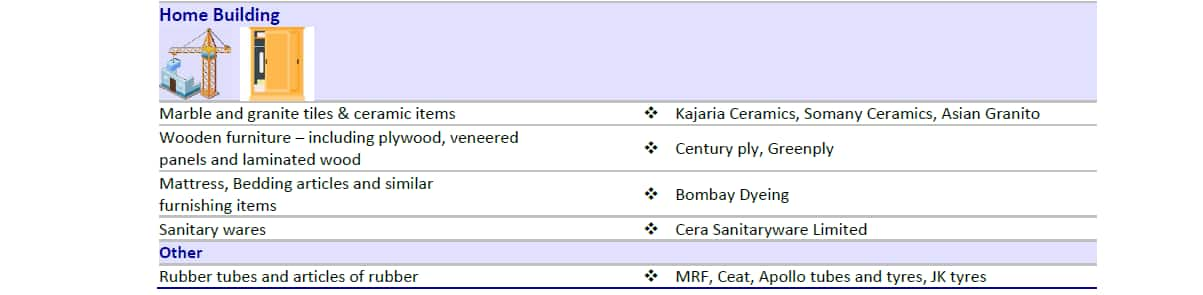

From the FMCG space companies which are likely to benefit the most are HUL, Emami, Gillette India. In the building material space companies which are likely to benefit the most are Kajaria, Somany Ceramics, Asian Granito, HSIL, Greenply Industries, and Century Plyboards,” he said.

Of the 228 goods that are currently under the highest tax slab, 178 will see a reduction in taxation. These primarily include mass consumption products, leaving only 50 luxury and sin/demerit goods like air conditioners, automobiles paints, cement, washing machines and tobacco, among others, in the 28% slab.

Also Read - Full list of revised GST rates for 178 categories of goods; Tax rate on five-star hotels unchanged

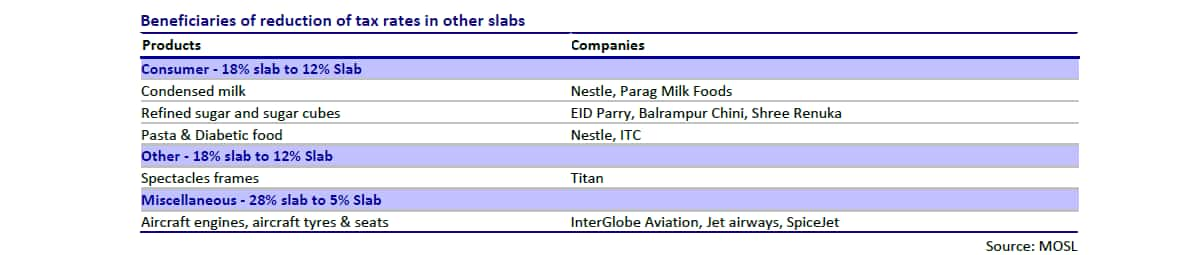

Taxation on selected items in few other tax slabs (18%, 12% and 5%) has been lowered. The GST rate on all restaurants (except in hotels with tariff exceeding Rs7,500/night) has been lowered to 5%, with no input tax credit.

The GST Council decided to impose a uniform GST rate of 5 percent across all categories of standalone restaurants — air-conditioned and non-air-conditioned — but withdraw the benefits of input tax credit (ITC) from such businesses, said a report.

“The 10% point drop from 28% to 18% in certain household and personal care items will certainly benefit companies in these sectors. We believe retail companies like Future Consumer and V2 Retail will be one of the prime beneficiaries along with FMCGs like HUL as they will see rise in turnover for these items,” Dinesh Rohira, Founder & CEO, 5nance.com told Moneycontrol.

“Additionally, even stationary articles including premium paper rates have been slashed hence we think JK Paper and West Coast Paper should gain from this move. As regards sanitary ware items, Cera Sanitaryware should benefit the most in this segment while shaving products maker Gillette India will rejoice too by this move,” he said.

There will be certain companies which might get adversely affected by the move especially cigarette and tobacco makers such as ITC, VST Industries which stand to lose the most.

“Other luxury goods like washing machines and ACs have been retained at 28% GST, hence stocks like Videocon Industries, Voltas, Blue Star stand to lose.

Even Paints and Cement sector stocks like Asian Paints, Nerolac, Ambuja, ACC etc. will get impacted by the move as there was no relief for these in the 28% GST slab,” said Rohira.

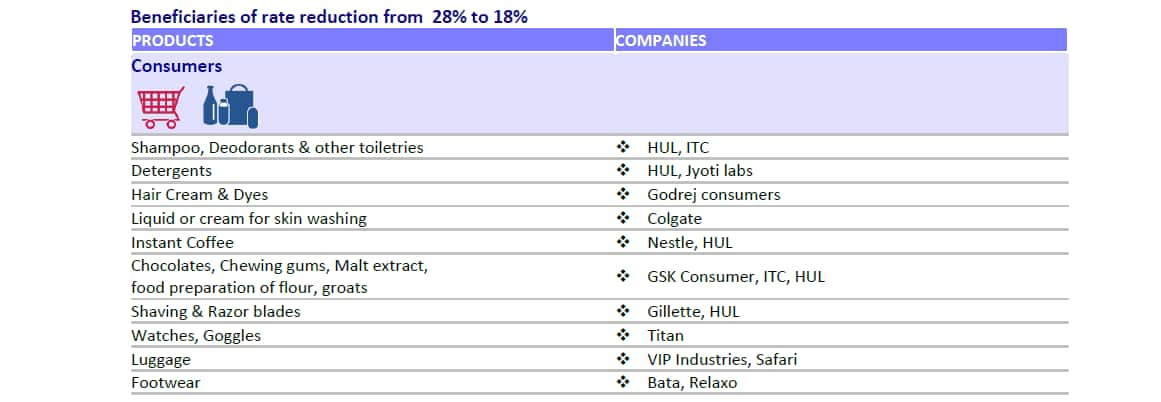

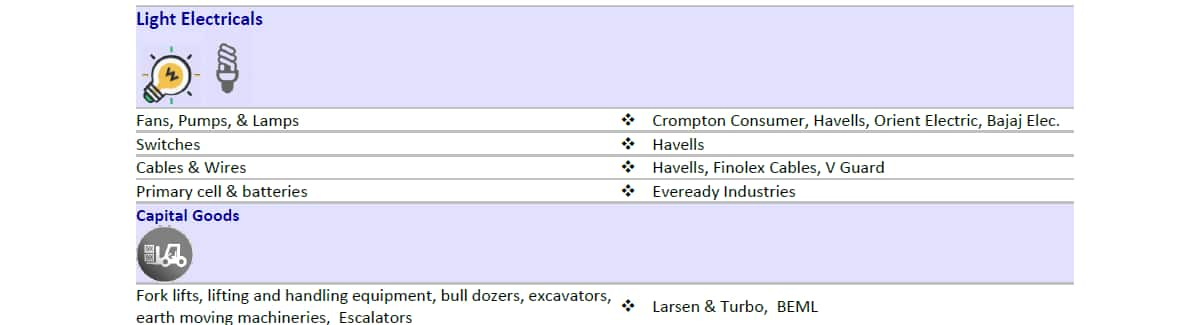

Domestic brokerage firm Motilal Oswal has come out with a list of stocks which are likely to benefit the most from the recent GST tweak:

Detergents, shampoo, hair color, chocolate & malt extract, instant coffee, deodorants, shaving cream, razor blades, luggage, footwear, watches, fans, switches, wires & cables, tiles, plywood , condensed milk, aircraft engines, aircraft tyres and aircraft seats amongst others have witnessed a significant reduction in duty.

“We believe that this will benefit companies like HUL, GSK Consumer, Gillette, Nestle, Havells, Crompton Consumer, Finolex Cables, Kajaria Ceramics, Somany Ceramics, Century Ply, Bata, VIP Industries, Interglobe Aviation, and Jet Airways among others,” Motilal Oswal said in a report.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!