Highlights:

- Q1 volumes came in six percent higher YoY

- Decline in VAM prices aided gross margin

- Bangladesh and Sri Lankan operations are progressing well

- Demand environment continues to remain challenging

- Valuations rich at 61 times FY20 estimated earnings -------------------------------------------------

The quarterly result of Fevicol-producer Pidilite Industries bucked the broader consumption growth moderation trend. Overall performance in Q1 FY20 was healthy as the revenue rose by double-digits and margin expanded on the back of benign cost environment.

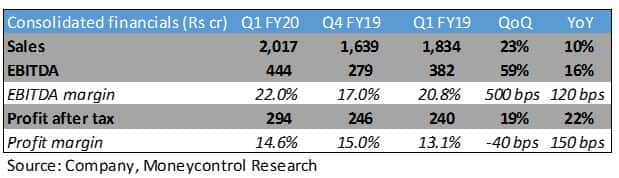

Highlights for the quarter gone byRevenue increased 10 percent year-on-year to Rs 2,017 crore in Q1 FY20, aided by higher volumes across both its business segments: consumer and bazaar and industrial products. Operating profit increased 16 percent to Rs 444 crore as margin improved on account of higher gross profit and cost control measures.

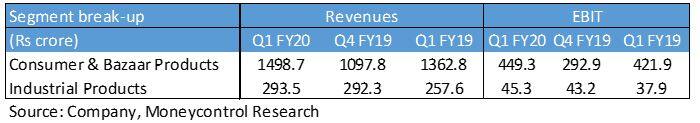

On a segmental basis, consumer and bazaar products grew in excess of 10 percent on the back of a six percent growth in volumes. Performance of industrial products was much stronger, with revenue surging 14 percent on account of a 12 percent increase in volumes. Growth in the latter across both business segments was fairly encouraging despite high competitive intensity and challenging market conditions.

The international business (7-8 percent of total revenue) continued to progress on a positive note. Growth in the overseas business came in at 11 percent and was led by healthy topline across Bangladesh, Sri Lanka, North America and United Arab Emirates (UAE). Revenue from Thailand was stable, but profitability was much weaker in comparison to the previous quarter. South American business also saw a turnaround at the operating level.

Gross margin recovery was aided by alleviation of input cost pressures. The prices of Vinyl Acetate Monomer (VAM), the key raw material for Pidilite, have been on a downtrend since the start of 2019. Prices of the same are currently hovering around $870-900 and have declined significantly from levels of $1,100 at the start of this year.

Given the steep decline in raw material prices, the management has initiated price cuts across its portfolio to pass on the benefit to its consumers. The aggregate impact of price reduction is expected to be around two percent. However, its gross margin is anticipated to move higher from current levels.

Overall, the demand environment has further moderated in the last quarter. The management indicated that stress in certain pockets of the construction and real estate segment could pose some challenges to its medium term growth. However, the company remains well positioned to grow in a competitive business environment and remains focused on improving its business and margin mix through new product launches such as Fevicol Ezee Spray and Roff Cera Clean.

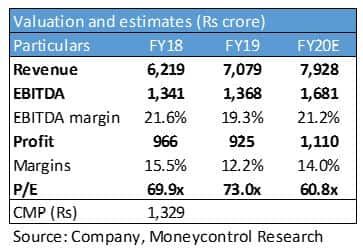

Outlook and recommendationAlthough the company has reported a pick-up in volume growth sequentially (two percent in Q4 FY19), the near-term demand environment continues to remain challenging, amid rising competitive pressures and slowdown in the domestic economy.

The company enjoys a numero uno position in the adhesive market on the back of its extensive distribution network and strong brand presence (Fevicol, Dr Fixit, Fevikwik and M-Seal). Pidilite has a proven track record and should be kept on the radar for accumulation during market corrections as current valuations (around 61 times FY20 estimated price-to-earnings) appear fairly rich and leaves little room for upside from a medium-term perspective.

Also read: This stock could be the next Havells

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!