Dabur India share price was down a percent in morning trade on May 28 after the company reported a 24 percent year-on-year (YoY) decline in consolidated net profit for the Match quarter of FY20 at Rs 281.6 against Rs 371.49 crore in Q4 FY19.

The company also reported a one-time loss at Rs 20 crore. Consolidated revenue for the quarter came at Rs 1,865.4 crore against the CNBC-TV18 poll of Rs 2,173 crore.

The stock price was quoting at Rs 431.70, up Rs 2.95, or 0.69 percent at 09:37 hours. It has touched an intraday high of Rs 433.70 and an intraday low of Rs 421.45.

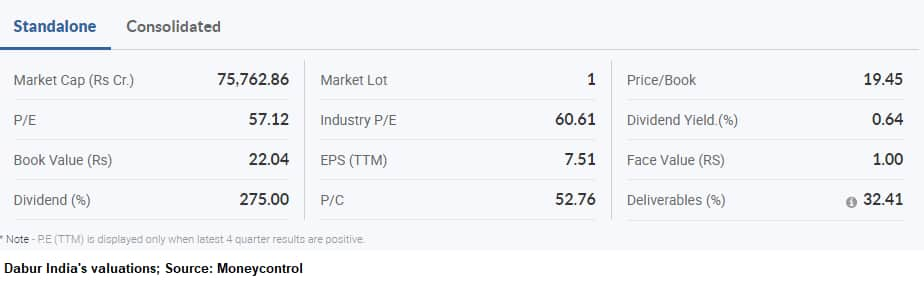

The company's Board has recommended a final dividend of Rs 1.60 per equity share having face value of Re 1 each for the financial year 2019-20, it said in a filing to the exchanges.

However, global research firm Jefferies has maintained a buy call on the stock and has cut target to Rs 500 from Rs 552 per share. It is of the view that domestic volume decline of 15 percent is among the worst in its history. The firm still finds Dabur a strong thematic play with the stock yet to fully reflect current headwinds. It has cut FY21-22 EPS forecasts by 2-3 percent, according to a report by CNBC-TV18.

Another research firm Credit Suisse has an outperform rating on the stock and has cut target to Rs 475 from Rs 500 per share. It is of the view that international business did relatively better in the fourth quarter while Middle-East likely to be a drag in H1 FY21. The firm has cut its earnings estimates for FY21/22 by 8 percent.

According to Moneycontrol SWOT Analysis powered by Trendlyne, Dabur India has zero promoter pledge with the company having low debt. However, Moneycontrol technical rating is very bearish with moving averages and technical indicators being bearish.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!