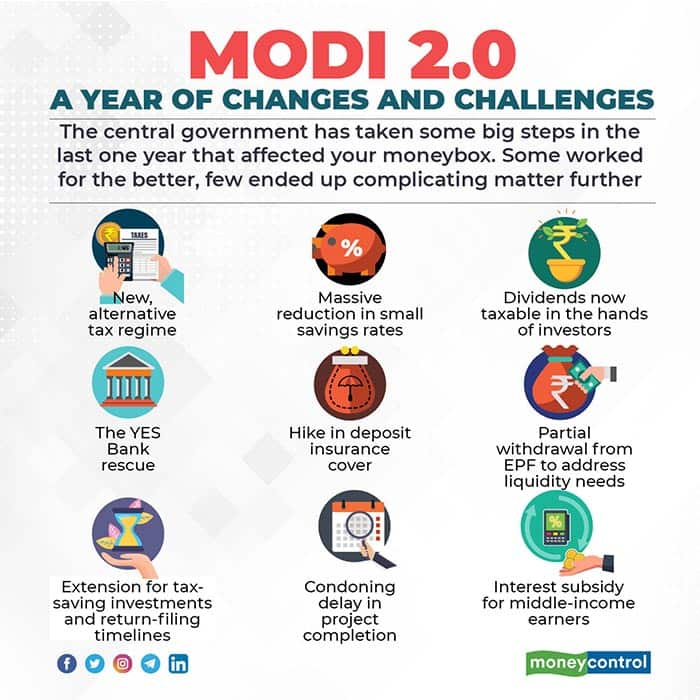

It’s been an eventful first year in office for Prime Minister Narendra Modi and his cabinet, sworn in on May 30, 2019, after a thumping win in the General Elections last year. Since then, a series of decisions by the re-elected government has had an impact on our finances.

Here is a handy recap of how money matters have changed across taxes, investments, insurance and loans.

Taxation

New, but not improved, slab rates

In the first full budget of Modi 2.0 presented in February 2020, finance minister Nirmala Sitharaman introduced a new, optional tax regime. With liberalised slabs and lower tax rates, it was presented as a preferable alternative to the existing system. However, most tax-payers will be better off sticking to the existing current system that offers benefits under section 80C, 80D, standard deduction, house rent allowance and so on. Most popular tax breaks will not be available under the new regime, rendering a switch futile, except for those who detest paperwork or are unable to optimise current tax reliefs. Even for such individuals, it is advisable to make an effort to utilise tax-saver avenues.

“This is one of the biggest taxation measures in recent times, but also one that has left many tax-payers in a quandary. Also, note that senior citizens will not be eligible for the higher basic exemption limit (Rs 3 lakh) available under the existing tax regime,” points out Archit Gupta, Founder and CEO, Cleartax. Not surprisingly, according to SBI Research estimates, less than 10 per cent tax-payers are likely to migrate to the new regime.

Now, pay tax on dividend income

Another dampener in Budget 2020 was the finance minister’s announcement that dividend distribution tax will be abolished; but dividends earned will now be taxable in the hands of investors. For investors who bank on income from dividends, this measure means increased tax as also compliance burden.

High salary earners hit

The Budget imposed an annual cap of Rs 7.5 lakh on employers’ contribution towards the Employee Provident Fund (EPF), National Pension Scheme (NPS), and approved superannuation funds. Contributions above this limit would now be subject to tax. “This will hurt individuals falling in the higher tax slab, and so will the taxation of dividends in the hands of taxpayers,” says Prableen Bajpai, Founder, FinFix Research & Analytics.

The Budget imposed an annual cap of Rs 7.5 lakh on employers’ contribution towards the Employee Provident Fund (EPF), National Pension Scheme (NPS), and approved superannuation funds. Contributions above this limit would now be subject to tax. “This will hurt individuals falling in the higher tax slab, and so will the taxation of dividends in the hands of taxpayers,” says Prableen Bajpai, Founder, FinFix Research & Analytics.

Investments

A big cut for small savings

Small depositors, particularly senior citizens, already grappling with lower fixed deposit rates, suffered another blow in March when the central government decided to reduce returns offered on small-saving schemes for April-June 2020 sharply.

The first year of the Modi 2.0 was marked by falling interest rates. The ten-year government bond yield – a widely tracked benchmark – came down to 5.98 per cent on May 26, 2020, compared to 7.13 per cent on May 30, 2019. Abundant liquidity infusion by the Reserve Bank of India and reduction in policy rates ensured that the yields declined.

Reserve Bank of India cut repo rate by 200 basis points – from 6 per cent to 4 per cent over the last one year. Falling interest rates also impacted the small-saving schemes backed by the Government of India. For example, the public provident fund used to earn 8 per cent for the April-June 2019 quarter. However, the same has been brought down gradually and stand at 7.1 per cent for the April-June 2020 period. Similarly, interest rates on the senior citizen saving scheme is down to 7.4 per cent from 8.7 per cent over same period of time. LIC’s Pradhan Mantri Vaya Vandana Yojana (PMVVY) too, is reintroduced with a cut in interest rates on offer to 7.4 per cent from 8 per cent earlier. Interest rates are expected to remain low in the short term due to the growth focus.

A low-cost, low-risk ETF for bond investors

To fund the loan requirements of Central Public Sector Undertakings (CPSUs) in a cost-efficient way, the Government rolled out the maiden Bharat Bond ETF in December 2019. The ETF, managed by Edelweiss Asset Management Company, garnered Rs 12,395 crore from 55,000 investors. While the three-year variant of the Bharat Bond ETF gave 5.14 per cent returns since inception, the ten-year variant delivered 6.42 per cent, according to Value Research.

The expense ratio is a paltry 0.0005 per cent. The ETF is a low-cost vehicle for the investors looking to buy a diversified bond portfolio with very low credit risk.

Banking

YES Bank: Rescued in the nick of time

State Bank of India pulled the crisis-ridden Yes Bank out of a quagmire role in February-March this year. In the process it calmed the nerves of panic-stricken depositors and assuaged the banking system reeling under the impact of the PMC Bank crisis in September 2019.

Customer-friendly loan rate regime

Earlier in August, a nudge from the finance ministry to public sector banks set the ball rolling for the external benchmark-linked lending regime. This policy promises greater transparency and better transmission of RBI’s rate actions for retail floating rate loans. While the switch was mooted by the central bank in 2018, it was put on hold following reservations expressed by banks.

From October 1, 2019, all new retail floating rate loans have to be mandatorily linked to an external benchmark. Most banks have chosen the repo rate as their benchmark. The new regime will be particularly beneficial to existing borrowers who often felt short-changed as banks dragged their feet while passing on benefits of rate cuts, but hikes were instantaneously effected. Moreover, fresh borrowers were often lured with lower rates, without passing on proportionate benefits to older borrowers. In the external benchmarking regime, banks will have to transmit policy action fully to their borrowers.

Depositors now more secure

In Budget 2020, the finance minister also announced a hike in deposit insurance cover from Rs 1 lakh to Rs 5 lakh – a much-needed revision in light of the PMC Bank crisis. In April, the RBI cancelled the licence of two co-operative banks that had been under suspension, paving the way for their liquidation and insurance claim payout by the Deposit Insurance and Credit Guarantee Corporation (DICGC) to the depositors.

Merging public sector banks

Ten banks were clubbed into four during the year. Customers of the merging banks had to deal with concerns around transactional niggles. The amalgamation necessitated updation of new account details with the income tax department to ensure smooth receipt of refunds, mutual funds to make investments and receive redemption proceeds and insurance companies for receiving maturity proceeds. Mercifully, the insurance regulator IRDAI allowed acquiring banks to continue with existing group health covers for bank customers, which was a relief especially to senior citizens.

Cost of electronic transactions down for customers

Effective January 2020, finance minister Nirmala Sitharaman had announced that Merchant Discount Rate (MDR) charges for businesses with over Rs 50 crore annual revenues will be waived. MDR is the percentage of the digital transaction that a merchant pays to banks, which is often borne by the customer. This waiver means that low-cost digital payment modes such as BHIM UPI, UPI QR Code and Aadhaar Pay are now exempted from MDR charges.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!