Tejal Gandhi

Retirement is the second innings of your life. It is rightly said that retirement means a life of leisure and peace. After working hard for decades, this is the time to spend for yourself and your family.

Ideally, you must start planning for your retirement the day you get your first pay cheque, which means investing a certain portion – no matter how small – of your salary in retirement benefits and funds. Once you create this corpus, you must also strive to nurture and insulate it against shocks. Protecting your retirement nest egg is important, especially in times of crises such as the one we are facing at present.

Avenues for investment

Good habits reward you always. Allocating your retirement funds is the process of planning and managing your corpus deftly. It involves forecasting the required cash flow in future – you need to analyse your financial needs. Start with calculating your post-retirement income and expenses. In terms of standard of living, expenses tend to come down by 5-10 per cent post-retirement.

So, where can you invest your retirement corpus so that it stays safe, particularly in these volatile COVID-19 times? Look at instruments that offer security and fixed returns. The options include bank fixed deposits, which offer interest rates between 5-7 per cent. Then, there are company fixed deposits, which offer higher rate of interest than many banks. However, you must evaluate the rating of the companies – it should be AAA or sovereign.

Senior citizen savings scheme (SCSS), a government-backed scheme that allows investment of up to Rs 15 lakh, is another option. Interest of 7.4 per cent is payable quarterly. You can also consider the Pradhan Mantri Vaya Vandana Yojana (PMVVY). It is a pension scheme, announced by the Government of India, available through LIC. It is extended for subscription till March 2023. The interest rate is 7.4 per cent per annum and you can choose the payment frequency – that is, monthly, quarterly, half-yearly or annually. If you can take on some risk, some part of your portfolio can be allocated towards debt, equity of hybrid mutual funds, depending on your risk appetite and time horizon.

Balanced portfolio

Your portfolio should be a balance among income generation, capital protection and growth.

Let’s understand this with the help of a case study.

Kannan retired a couple of months back from a private company. He received a corpus of Rs 75 lakh upon his retirement. He does not get any kind of pension from the company. He had invested in some pension schemes and will now start getting benefits of Rs 20,000 per month. He has a monthly requirement of Rs 50,000 – that is, his expenses. He also earns a rental income of Rs 10,000 every month. He has taken a health insurance cover of Rs 25 lakh for him and his wife. His risk profile is moderate.

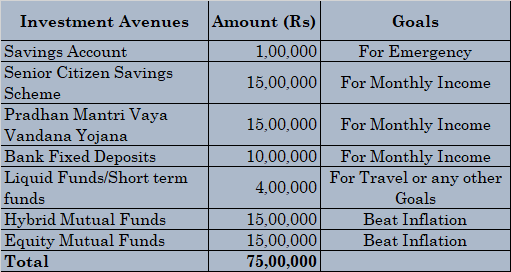

The different options in which he can invest his corpus are:

He can get a good cash flow to take care of his regular expenses through his investments. He has kept aside some amount to beat inflation for his future expenses.

After investing your retirement funds such that they last through the golden years, it is also important to do proper estate planning. The basic step is to write a Will. Leave a legacy for your children.

(The writer is CEO and Founder, Money Matters)

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!