General and health insurers have started launching standard Corona Kavach (reimbursement) and Corona Rakshak (fixed benefit) health insurance policies for covering COVID-19 treatment. You can either buy the policies through their websites or approach their branch offices or agents.

Several insurers including United India, Oriental, National Insurance, Bajaj Allianz, Star Health and Max Bupa, among others, have launched Corona Kavach. Some insurers such as Star Health, IFFCO Tokio and Universal Sompo have designed both Corona Kavach and Corona Rakshak policies.

Corona Kavach offers sums insured of Rs 50,000 to Rs 5 lakh, while Corona Rakshak’s cover amount will be between Rs 50,000 and Rs 2.5 lakh.

Also Read: Corona Kavach: Check out all the details of COVID-19 health insurance policy

Moneycontrol had detailed the features and clauses earlier. Now, it remains to be seen how easy insurers will make it for individuals to actually buy policies. “We need to see whether the underwriting process (scrutiny of applicants’ health) would be simple, especially for the vulnerable population, senior citizens and people with pre-existing diseases, among others,” says Mahavir Chopra, Founder, Beshak.org, an insurance research platform.

Insurers will most likely make additional enquiries while assessing your health risks before issuing policies.

Corona Kavach: Cheaper than regular and Arogya Sanjeevani policies

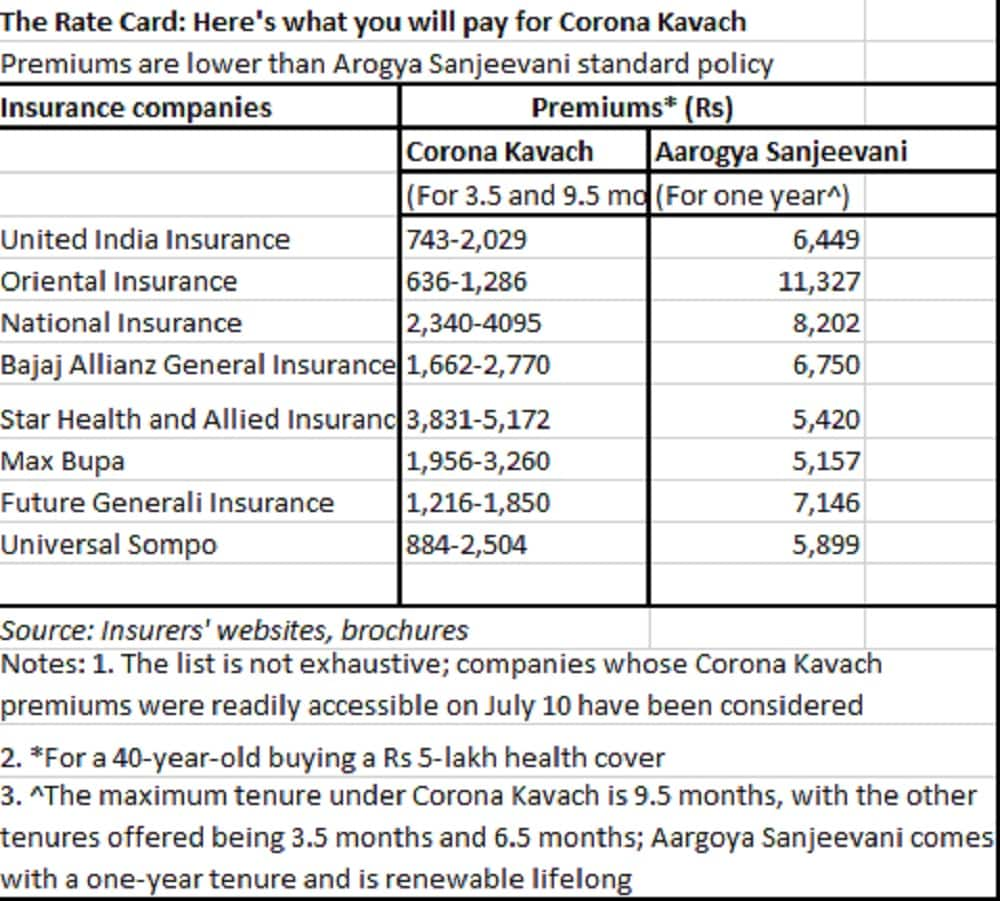

The premiums are in the region of Rs 636 to Rs 3,831 across insurers for a 40-year-old buying a Rs 5-lakh base cover for 3.5 months, which is the minimum policy term.

The maximum tenure is 9.5 months and this pushes up the premiums to Rs 1,286-5,172.

Health workers will get a discount of five per cent. The premium range could see changes as more insurers unveil their standard products. These policies are cheaper than Arogya Sanjeevani standard, reimbursement-based regular health policy.

To be sure, Arogya Sanjeevani does come with a longer tenure of one year, while the maximum tenure under Corona Kavach is 9.5 months. The former also offers coverage for wider range of ailments, lifelong renewability and portability. Yet, from the pricing standpoint, those looking specifically for insurance against COVID-19 will find Corona Kavach’s premiums more attractive.

It does not impose any room rent sub-limits, which can substantially increase your out of pocket expenses, besides explicitly covering home care treatment. Moreover, co-morbidities – that is, pre-existing ailments - triggered by COVID-19 will be covered alongside treatment of the contagious disease after an initial waiting period of just 15 days.

Experts, though, point out that the pandemic will run its course at some point in time, but the need for health cover will always persist. “Accidents, dengue and heart attacks will continue to pose risks. It is a good idea to look at Arogya Sanjeevani and buy COVID-specific covers for extra protection. Insurance should be bought as a long-term risk-mitigation tool and not out of panic,” says Bhabatosh Mishra, Director, Claims, Underwriting and Product, Max Bupa Health Insurance.

Corona Rakshak: Not as useful as regular benefit-based policies

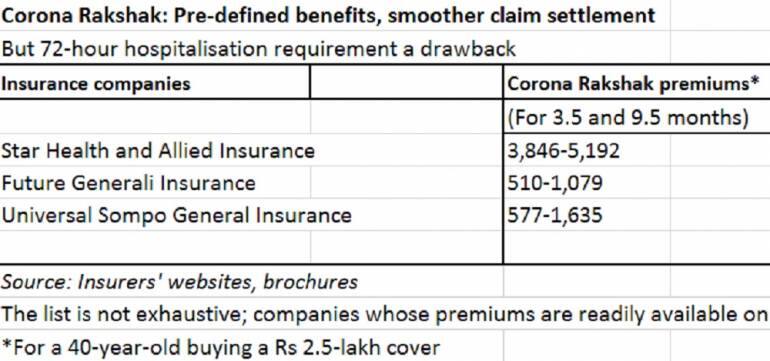

While Corona Kavach reimburses the actual cost of treatment up to the sum insured, Corona Rakshak will pay out the entire sum insured if the policyholder is hospitalised for at least 72 hours for COVID-19 treatment.

Benefit-based policies hand over the sum insured to policyholders if they are diagnosed with the ailments covered under the policies.

For example, a dedicated cancer cover will pay the entire sum insured once the policyholder is diagnosed with the illness. Similar is the case with critical illness policies that cover a range of dreaded diseases like cancer, cardiac arrest, stroke, renal failure and so on. They do not insist on hospitalisation and policyholder can make a claim even if she has already filed a claim under regular, reimbursement-based policies.

This mechanism ensures that policyholders are not inconvenienced due to disputes between hospitals and insurers, like the ones being witnessed currently.

However, Corona Rakshak’s insistence on minimum of 72-hour hospitalisation is a limitation. Home treatment is the preferred choice of many asymptomatic and mildly symptomatic patients who have the wherewithal to quarantine themselves at home while being treated. Therefore, this clause will be hindrance for those wishing to buy this policy due to the hassle-free claim settlement benefit policies otherwise offer.

Moneycontrol Take

An adequate, regular health insurance policy with no room rent sub-limits and co-pay is ideal for any individual. These cover a broad spectrum of ailments and surgeries unlike disease-specific plans such as Corona standard health cover twins.

Buy one when you are younger so that the waiting period for pre-existing ailments is over by the time you turn older and hence, at risk for lifestyle ailments. COVID-19 has imparted an important lesson: health emergencies can come knocking at any age.

If you are 40, buy a larger cover of at least Rs 10 lakh and review this sum insured every five years to account for healthcare inflation. If you cannot afford large, regular covers, Arogya Sanjeevani is a cost-effective option. You can also enhance your health cover through super top-up plans that are triggered only after your regular base cover is exhausted. A combination of base and super top-up plans provides a large health insurance cover at lower premiums.

If you cannot think beyond COVID-19 at the moment, you can consider COVID-19 standard covers, given the much cheaper premiums, short waiting period and coverage for co-morbidities. But remember, these are limited period plans. You will need health cover when you are older and regular policies are renewable lifelong.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!