Bhavana Acharya

A 40 per cent plus one-year return is mouth-watering. You may wish to jump at the chance to snap up such high returns. And the fact that it is gold that’s delivering such returns makes it even more attractive. But how has gold delivered in the past? What can you expect from gold as an investment?

Gold’s returns over different timeframes over the past 20 years throw up the following trends:

- Gold returns can swing sharply from year to year

- Gold has posted very strong returns in a few years and, such years, over a long timeframe, have helped make long-term returns tick

- Predicting when gold can generate high return is difficult

A few years make the difference

Domestic gold prices are a factor of global gold prices and the exchange rate (plus duties). But unlike stocks and bonds, gold does not generate its own cashflows or internal growth and valuation metrics. Gold prices are typically tied to fortunes of the equity market. A risk-off equity scenario in global markets sends gold prices surging, as investors move to safety and vice versa.

Outside equity market sentiment, gold demand and supply mismatches are driven by central banks stocking up on the yellow metal, jeweller buying and selling, and mining supply. However, while these are drivers that do affect prices, the big jumps in gold returns usually come by during equity market uncertainty. This has two implications.

One, gold can spend a number of years delivering low to flat returns. In the period from January 2013 to December 2018, gold prices went virtually nowhere, with an absolute return of 1 per cent. Considering all the periods since 2005, gold delivered less than 5 per cent in returns about a quarter to a third of the time in the one, two, three and five-year periods.

Two, gold returns spike sharply in phases. These rapid price gains help compensate for the periods of flat performance in between and push long-term returns higher.

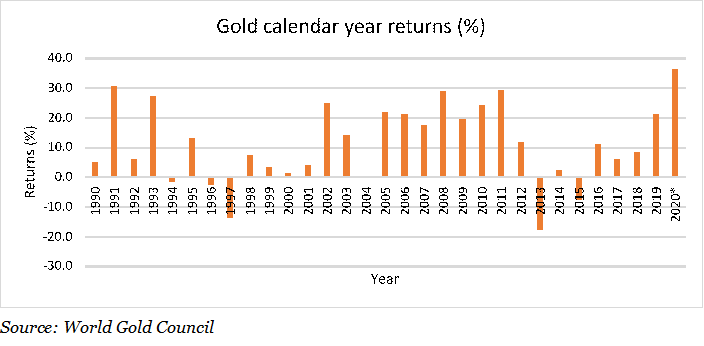

The graph below shows the calendar returns of gold since 1990. Strong returns have come in periods such as 2008, 2010 and 2011, which were turbulent times for equity markets. But these gains have helped propel gold’s long-term returns, even as earlier years saw less exuberant performances.

For instance, consider gold’s current upswing. The 30 per cent-plus return year-to-date has served to pull five-year returns to 10 per cent and higher. Until this burst, gold’s five-year returns were as low as 1-2 per cent in early 2019 and 6-7 per cent at the close of 2019, on a five-year basis.

Returns can be volatile

While gold’s current run is enthralling, returns for the metal have historically been volatile. Equity is more volatile than gold, going by return deviations over different timeframes. However, gold is different in that it has been more prone to generating losses in different timeframes.

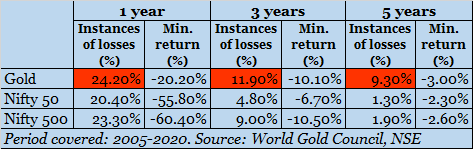

Consider the period from 2005. The table below shows the proportion of times gold delivered a loss, and the best and worst returns it has given over different timeframes.

Holding equity for the long term cuts down loss probability and lowers volatility. For gold, though, while overall volatility does dip, loss probability remains higher than equity for the most part. The instances of losses in the Nifty 50 and even the Nifty 500 have been lower than gold, especially over a longer timeframe.

Further, gold’s long-term returns have ranged around 10-12 per cent. For example, in the 3, 5, and 10-year periods, gold’s returns were nearly 10 per cent close to half the time over the past two decades. The metal delivered more than 15 per cent return about a third of the time over the 3 and 5 year periods. Further, where gold did deliver 15 per cent-plus, it was mainly concentrated in the years of 2010-2012. These years were some of the strongest for gold, with the metal steadily making new highs. Outside these years, returns have not frequently moved beyond 20 per cent.

How can gold be used as an investment?

So what’s the takeaway from gold behaviour over the years?

One, it is hard to predict returns. Gold generates outsized gains primarily due to events that cause a global risk aversion to equity. Such events are, obviously, hardly predictable. So it becomes hard to time entry to capture those gains, though gold investing works very well on correct timing. It’s usually in hindsight after returns have shot up – like now – that the interest in gold investing surges.

Two, it is most useful as a hedge. With the long periods of underperformance, the higher probability of losses even in three and five-year periods, unpredictability of returns, and returns overall remaining in the 10 per cent range, owning gold as the main portfolio component is not the best idea. The key gold price driver is equity turmoil. And given the very sharp gains gold can make, it can neatly compensate equity losses. For example, in an SIP run for the past 10 years, a 10 per cent allocation to gold and debt each, with the rest in equity, increased portfolio IRR (internal rate of return) by 80 bps.

Three, it is best used only in long-term portfolios. While gold is useful as a hedge, such hedging is best done for long-term portfolios only. This is because gold is equally volatile over shorter periods. Hence, if you have very short-term goals of less than two years, safe debt options such as deposits would serve to protect capital better than gold.

(The writer is Co-founder, PrimeInvestor)

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!