Admission processes are going on in the colleges for graduation and master’s program across streams. Several students and their parents have now started research on education loan products with banks and NBFCs. Now-a-days, students are also applying for education loan online on peer-to-peer (P2P) lending platforms.

Manav Jeet, MD & CEO, Rubique said: “The most important thing to be considered before borrowing for education purposes is if there is a loan offered for the course selected at the college. Because some institutes or courses are not recognised and getting an education loan for these may prove to be difficult from any lenders.”

Let us do a comparative study on taking education loan from Banks, NBFCs and P2P lenders.

Factors to consider while applying for education loan

Gaurav Aggarwal, Associate Director, Unsecured Loans at Paisabazaar.com said, “The decision to choose between education loans from banks, NBFCs and P2P lenders should be based on the interest rate, other fees and charges, loan tenure, re-payment flexibility, collaterals/margin money/guarantors requirement, asked by the lenders.” As these can vary widely across various lenders, education loan applicants should compare loan offers and eligibility online with lending marketplaces before closing on a particular bank.

Banks are most preferred institution for long term education loan. “However, banks are not willing to give education loans for short term or vocational training program. So any working individual looking for vocational training through physical or digital classrooms, can apply for short term education loan online from P2P lenders,” said Bhavin Patel Founder and CEO of LenDenClub.

Know your repayment cycle before applying for loan

Unlike other term loans like home loans or personal loans, repayment for education loans do not need to start immediately. Adhil Shetty, Co-founder & CEO, BankBazaar.com explained, “Banks provide a period as a moratorium before you need to start making repayments. You do not need to start your repayments during your entire course span as well as for some more time post that. This moratorium or waiver period varies from bank to bank and you must check with your bank about the waiver period before planning your education loan repayment.”

However, keep in mind that some banks start charging the interest on education loans immediately and not wait until the waiver period ends. So, the longer you wait to begin the repayments, the higher interest you would be paying.

Average processing time for education loan

Banks and NBFCs function traditionally with an extremely stringent policy and a plethora of documentation is required to process a loan application. P2P platforms ensures that the loan process is considerably shorter compared to banks by involving technology at every stage of the process thus bringing the turnaround time down. Patel said, “Average processing time for education loan from banks is 15-21 days, NBFCs 10-15 days and P2P lenders 2-3 days.”

Interest rates and processing fee

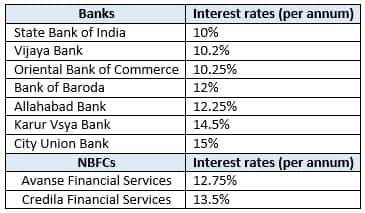

Banks outscore other lenders in terms of interest rate and processing fee. Aggarwal said, “Their interest rates can range anywhere from 10 percent p.a. to 15 percent p.a. depending on the education institution, course type and loan amount. Most banks do not charge any processing fee on their education loans. Whereas, NBFCs charge interest rate of 12 percent (and above) on their education loans and their processing fee can go up to 2 percent of the loan amount.”

Illustration: Interest rates charged by some of the banks and NBFCs

The interest rate and processing fee charged by P2P lending platforms would depend on the risk assessment of the borrower made by the lending platform and/or individual lender. “The low-risk borrower will get an interest rate of 15-18 percent while the rate for a high-risk borrower can go up to 25-30 percent,” said Patel.

Jeet explained, “For traditional financial institutions, the interest rate is largely a function of the cost of funds of the lender, but for NBFCs and P2P platforms, it is the borrower’s profile which determines the interest rate. So, the rates are decided based on the risk associated with the borrower on their scoring mechanisms.” Every P2P platform usually has their own data points and parameters to determine the interest rates.

Tax benefits

Education loans taken from all banks qualify for tax deductions under Section 80E. However, when it comes to NBFCs, only those notified by the government as ‘financial institution’ under Section 80E (3)(b) through official gazette qualify for tax deduction. Surendra Kumar Jalan, Founder and CEO, OMLP2P said, “There is no tax deductions applicable on education loan availed from P2P platform as of now.”

Advantages and drawbacks

Jalan discussed some of the key advantages and drawbacks of taking education loan from banks, NBFCs and P2P lenders as highlighted below:

For Banks and NBFCs

Advantages:

- Significance of credit score is comparatively less with collateral-based loans

- Higher amounts can be borrowed with collateral

- Longer loan payback durations are permitted

Disadvantages:

- Higher interest rates in case of NBFCs compared to banks

- Banks and NBFCs are likely to impose a penalty for pre-closure of loans

- Longer Turnaround time

For online P2P lending

Advantages:

- Easy and quick online loan processing

- No prepayment penalty

Disadvantages:

- Borrowers with bad credit and scores below specific cut-off limits are not eligible for loans

- Repayment period can’t exceed 36 months and loan amount cannot exceed Rs 10 lakhs

Penalties of defaulting on education loanThe education loan interests are not low. The later you start repayments, the more would be your loan burden. Shetty advised, “It is best to begin repaying your loan as soon as possible without utilizing the moratorium period to keep the interest rates to the minimum. In case you actually end being unable to pay your education loan, you will be starting your career with a poor credit record and would be ineligible for further loans.”

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!