Vidya Bala

From September 2018, since the time the IL&FS crisis started, it has not been an easy ride for debt fund investors. Just when they think that one uncertainty is behind, a fresh bout hits them. If there are some key learnings from these past 18 months, it would be the following.

Returns mask risk

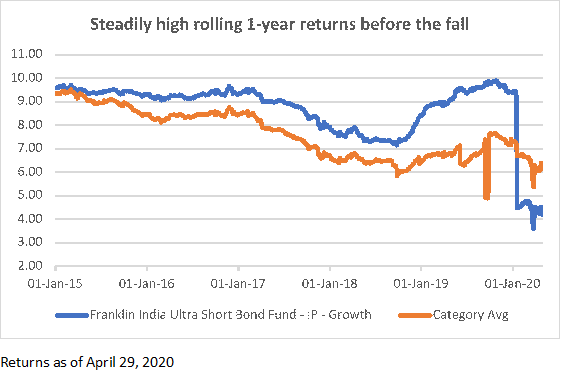

Many of you may have picked debt funds like the way you select equity schemes – based on the top returns in the category. You may have gone one step further and even looked at how volatile it is, whether it had instances of negative returns etc. Unfortunately, all of these metrics can be in great shape in a high-risk debt fund, until it fails. Look at the graph below of the Franklin India Ultra Short Bond fund (one of the six debt schemes that were wound up in April).

For a fund that had steadily delivered at least 1.2 percentage points above the category average, and as high as over 3 percentage points, the impending fall would never have been anticipated by even a long-term investor in the fund.

Learning: Returns mask risks. A fund with credit risk tends to be extremely steady and delivers high returns without any volatility. What do you do about this? When a fund is steadily delivering significantly higher returns (and 1-2 percentage points higher in debt is not easy) especially in categories with low duration, the first question to ask yourself is where are the returns coming from. That should lead you to the portfolio make up.

Yields do not translate to returns

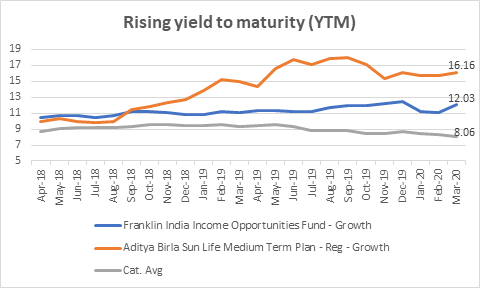

For those who chose debt funds thinking that high yields simply translated into higher returns (after expense ratio), it turned out to be the other way round. High yields were essentially a red flag for risk in the past two years. In general, a fund takes higher risks for higher accruals. Now, if you look at the graph below, you will see that Aditya Birla Sun Life Medium Term did have marginally higher yield than the category average but, at some point, zoomed head and shoulder above the category.

Franklin India Income Opportunities, on the other hand, had steadily higher yields. What does this tell? The former’s risk profile went up – downgrades cause yields to spike and put options that could not be exercised also caused yields to rise. That essentially meant it got riskier than before.

The Franklin fund, on the other hand, was steadily showing higher yields; and only in more recent times showing elevation in the trend. That essentially indicated it was taking higher risks at all times. The Birla fund on the other hand, started flashing red post September 2018.

Learning: Yield is not equal to returns. Where such high yield comes from (the underlying portfolio) is more important.

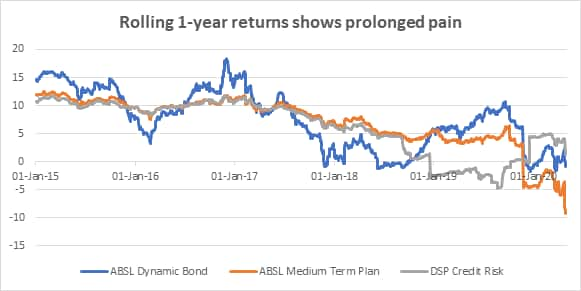

Hits may not be over

In funds that have already taken a hit, investors are often advised to stay on as things cannot go worse from there. But be it the further marking down of the Jharkhand road asset by Aditya Birla AMC in some of its schemes right after the Franklin fallout or by BOI for various papers last week, or the marking down by Principal AMC on its DHFL paper – all of these point to the fact that AMCs are not done with marking down distressed assets. Each one of the AMCs adopt different ways, and each has assets in which the hits are taken in instalments. If this be the case, staying with a fund, believing that the hit is over, is not without risks.

Look at some of the funds that had to take hits in the graph above. IL&FS, DHFL, Essel, and continuing issues with the first two assets, besides newer hits in Vodafone Idea or Yes Bank – these factors can cause prolonged pain. As the troubles compound, returning to normalcy gets that much harder.

Bottom line: Where a portfolio carries credit risk, one hit does not clean the portfolio. There may be more risks ahead!

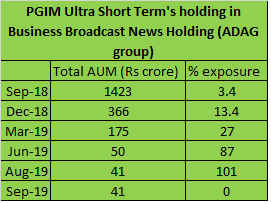

Concentration risk compounds the pain

One of the key reasons for the above-mentioned funds getting hit more, every time another downgrade or default happens, is the concentration of papers. When funds are confronted with a default and suffer redemption, then the concentration of other papers in the portfolio, especially, illiquid and lower quality ones, goes up.

One of the earliest examples from 2018 was the PGIM Ultra Short Term (then called DHFL Pramerica Ultra Short Term). The fund was among the worst hit from the DHFL fall. Facing severe redemption pressure, its exposure to other papers swelled. Just take a look at the data below of the fund’s holding in the ADAG group that hit insolvency.

A 3.4 per cent holding swelled to 100% what with the fund having to sell all other liquid papers under redemption pressure. When the ADAG group defaulted, this fund had to take a 100% hit!

Learning: Severe redemption causes quality papers may have to be sold, leaving poor credit/illiquid papers behind; heightening portfolio risk.

Average maturity may be deceptive

In the recent fallout of six of Franklin India’s debt schemes, Franklin India Ultra Short Bond had an average maturity of 0.6 years as of March 2020. It was therefore thought that the fund would return money roughly around the same time. However, complexity in calculation of the portfolio duration, use of put and call options and how they are factored etc. meant that the actual maturity of a large number of papers were actually well past the portfolio’s average maturity date.

Learning: It is not possible for a lay investor to know the complexities of calculating a fund’s duration. When you align your own time frame to that of the fund, it is not enough to go by the maturity. You will probably have to check the maturity of the papers (non-gilt, non-AAA) with the longest maturity in the said portfolio. That would be your maximum time frame in the event of a risk.

(The writer is Co-founder, PrimeInvestor)

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!