Nitin AgrawalMoneycontrol Research

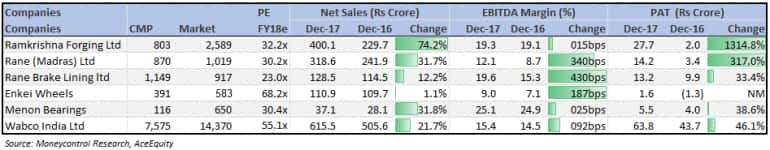

In the last couple of days amid the weakness in the midcap space, some stellar earnings from mid-cap auto ancillary companies may have missed your attention.

With all regulatory headwinds in recent times starting from demonetisation to transition to BS IV and finally GST rollout coming to an end, the numbers were worth taking a note of.

Ramkrishna Forgings (RMKF) is the second‐largest forgings player in India with a total capacity of 150,000 tonnes. It is a manufacturer of open and closed dye forgings of carbon and alloy steel, micro alloy steel and stainless steel forgings.

RMKF posted a strong volume growth of 62.2 percent (YoY) with domestic and export business recording a growth of 63.4 percent and 60 percent, respectively. The growth in the domestic business was mainly because of reduced regulatory headwinds and pick up in the commercial vehicle demand after GST.

The demand for the exports business was driven by pickup in demand of Class 8 Trucks in north American market. Strong volume growth led to 74.2 percent growth in net sales and 1,315 percent growth in PAT (profit after tax).

During the quarter the company also got sample approvals for 139 new items, out of which 83 items are for leading OEM’s (original equipment manufacturer) in India and 56 items are for exports.

Another company that caught our attention is Rane (Madras) Ltd, which is a leading manufacturer of steering and suspension products and die casting components.

Rane posted a strong growth of 31.7 percent in its net sales driven by strong demand coming from Original Equipment (OE) customers and robust demand in Indian aftermarket segment. The company witnessed an expansion of 340 bps in its EBITDA (earnings before interest depreciation and tax) margin on the back of increased volume, favourable product mix and improved operational performance.

Moneycontrol Research had initiated coverage on Rane Brake Linings Ltd. The company posted a very strong number in the quarter ended December 2017.

The company posted a healthy growth of 12.3 percent in its net revenues on the back of strong demand coming from passenger vehicles and two-wheeler. Additionally, the recovery of aftermarket pushed the demand for its products.

In terms of EBITDA margin, the company witnessed an expansion of 430bps (YoY) led by favourable commodity prices, foreign exchange movement and higher cost savings. The company continues to generate savings on employee and power cost through strategic initiatives undertaken in Q4FY17.

Enkei Wheels India Ltd, manufacturer of aluminium alloy wheels for two wheeler and four wheeler, surprised positively. While the company posted muted growth in its net operating sales, it managed to post a significant expansion of 187 bps (YoY) in EBITDA margin, which came at around 9 percent. Despite the rise in the aluminium prices, the company was able to post expansion in its EBITDA margin. In terms of bottom line, the company posted an after-tax-profit (PAT) of Rs1.62 crore as compare to loss of Rs1.31 crore in the same period last year.

Another company in the list is Menon Bearings, which is a manufacturer of engine bearing and aluminium die-casting. Riding well on the growth in commercial vehicle segment, the company posted a strong growth of 31.8 percent (YoY) in the net sales and its EBITDA margin came at around 25.11 percent. The company also posted a strong growth of 38.6 percent in PAT.

Last company in the list is Wabco India Ltd, which is manufacture of conventional braking products, advanced braking systems and other related air assisted products and systems. The company supplies its products mainly to Indian commercial vehicle segment.

Wabco posted a strong growth of 21.7 percent (YoY) in the net revenues on the back of healthy offtake from domestic commercial vehicle segment. The company posted an EBITDA expansion of 92bps and its PAT witnessed a strong growth of 46.1 percent (YoY).

Follow @agrawant

For more research articles, visit our Moneycontrol Research Page.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!