Sachin PalMoneycontrol Research

Navkar Corporation, the operator of container freight stations (CFS) and rail terminals, reported a steady set of numbers in the last quarter of FY18. The company reported its highest ever quarterly topline and bottomline driven by strong performance on all parameters. Navkar has seen a pick-up in growth momentum in the past 2 quarters on the back of strong volume growth at its Vapi terminal. We anticipate earnings acceleration in coming years as the company is expected to reap the benefits of the recently completed capital expenditure.

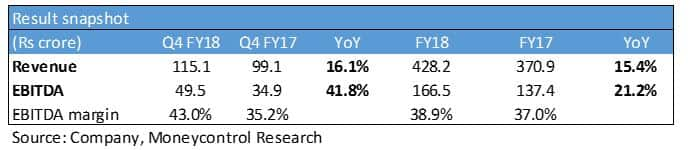

Strong operational performanceSales for the quarter gone by increased 16 percent to Rs 115 crore. Earnings before interest, tax, depreciation and amortisation (EBITDA) came in 42 percent higher than last year at Rs 49 crore as margin expanded significantly in the quarter gone by. Strong performance in Q4 helped it end FY18 on a solid note. For FY18, it reported a topline increase of 15 percent and operating profit growth of 21 percent.

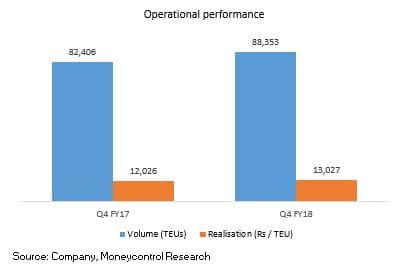

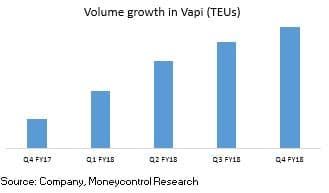

Revenue growth in Q4 was boosted by volume ramp-up at Vapi terminal as well as a moderate pick-up in realisations. Volumes handled at Panvel CFS remained largely flat. With its private freight terminal (PFT) at Panvel, the company services the export and import of containers at the Jawaharlal Nehru Port (JNPT). Vapi continues to witness strong volume growth on a quarter-on-quarter basis (QoQ). In Q4, it handled 14,433 TEUs (20-foot equivalent) compared to 2,886 TEUs on year. Vapi terminal volumes are growing at the rate of 30-35 percent QoQ.

Vapi terminal to drive earnings growthIn March, Navkar received final approval from the Indian Railways for operating a private freight terminal at Vapi. The approval is favourable to both the railways and Navkar as the distance between the two is around 175 km. Commencement of rail operation at Vapi is expected to further improve volumes and profitability as the company has an inland container depot at Valsad (Gujarat) along the industrial belt. The management expects to handle 5,000 TEUs per month through this terminal. The ramp-up in volumes will result in significant margin expansion as it will enjoy high operating leverage.

Vapi terminal to drive earnings growthIn March, Navkar received final approval from the Indian Railways for operating a private freight terminal at Vapi. The approval is favourable to both the railways and Navkar as the distance between the two is around 175 km. Commencement of rail operation at Vapi is expected to further improve volumes and profitability as the company has an inland container depot at Valsad (Gujarat) along the industrial belt. The management expects to handle 5,000 TEUs per month through this terminal. The ramp-up in volumes will result in significant margin expansion as it will enjoy high operating leverage.

Operationalisation of the fourth terminal at JNPT has raised cargo handling capacity of India’s largest container port by 50 percent. The anticipated 8-10 percent volume growth at Navkar’s Panvel CFS will be aided by recently commissioned terminal at JNPT.

Operationalisation of the fourth terminal at JNPT has raised cargo handling capacity of India’s largest container port by 50 percent. The anticipated 8-10 percent volume growth at Navkar’s Panvel CFS will be aided by recently commissioned terminal at JNPT.

Outlook and recommendationAided by industry tailwinds and increased trade activity, the company expects growth momentum to continue in coming years. Navkar (CMP: 125) appears to be an interesting investment opportunity for patient long term investors as the stock trades at nearly 10 times FY20e price-to-earnings multiple. With majority of the capital expenditure (establishment of a logistics park and set-up of railway facility at Vapi and CFS capacity enhancement) behind it, improving free cash flows will help it de-leverage the balance sheet (FY18 debt-equity ratio at 0.2 times) and push return ratios into double-digits.

For more research articles, visit our Moneycontrol Research page

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!