Highlights

China: leading trade partner; contribute to 18 percent of India’s imports

Import substitution plays to help de-risk supply chain

“Make in India” thrust can benefit chemicals, durables, auto and APIs

Export opportunity can amplify if global supply chain shifts

Agrochemicals, APIs, contract manufacturers, capital goods to be watched

__________________

China-India bilateral trade is a much debated topic in recent times due to multitude of factors ranging from challenges due to import dependency in some sectors to the business opportunities as the global supply chain potentially shifts from China to the rest of the world including India.

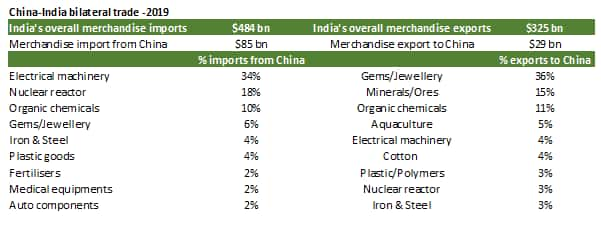

To put it in perspective, China is India’s one of the leading trade partners and constitutes 9 percent of India’s total export and 18 percent of total merchandise imports.

Import dependency on China for a range of raw materials (APIs, basic chemicals, agro-intermediates) and critical components (Auto, Durables, Capital goods) is skewed. To give a flavour, out of the respective imports, 20 percent of the auto components and 70 percent of electronic components come from China. Similarly, 45 percent of consumer durables, 70 percent of APIs and 40 percent of leather goods imported are from China.

Source: Ministry of Commerce, CRISIL, Moneycontrol Research

Import substitution aka “Make in India”

For some of the sectors, the impending supply risk and the policy shift towards self-reliance is likely to translate into what is commonly referred to as “make in India” or import substitution.

Even before current crises, various companies have been working towards import substitution as a key business case to succeed. In Chemicals, Amine players (Balaji Amines & Alkyl Amines), rubber chemicals (NOCIL), Carbon black (Himadri Speciality & Phillips Carbon), Engineering plastics (Bhansali Engineering) are the areas to look at as they remain beneficiary of government’s steps to curtail import dependence.

Further, basic chemicals can gain traction because of the imperative to minimize supply chain risk. Companies to look at are Deepak Nitrite and GNFC as China factor has brought focus on key raw materials such as Acetone, Phenol, Aniline, Acetic Acid and Nitric Acid which are heavily imported.

In case of Pharma, import dependency for key starting materials/APIs means companies such as Aarti Drugs, Granules India, JB Chemicals, IOL Chemicals would also be worth tracking. Some of them are key manufactures for drugs/APIs such as Paracetamol, Metronidazole and Ibuprofen and are increasingly attempting backward integration.

In the consumer durable space, the trend of in-house manufacturing is as well been evident for domestic players such as Havells and Voltas which have recently set-up in-house manufacturing facilities to reduce import dependencies.

In the Auto equipment segment, Lumax Industries is setting up of an electronics facility for localising component manufacturing. Further, Maruti is focused towards manufacturing various imported electronics parts, locally after witnessing recent supply disruptions.

Export opportunity: Supply chain shift away from China

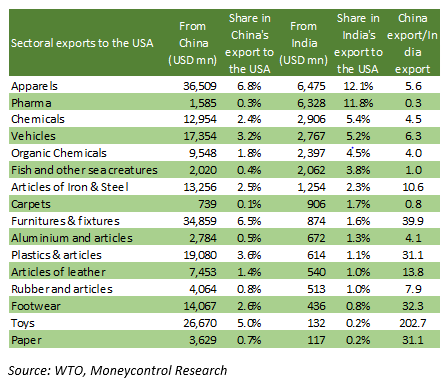

On the export front, we think opportunity for Indian manufacturers are humongous if there is a sizeable shift in opportunities from China to India. A look at the India-USA trade gives some clue. A good portion of India’s current exports to the USA consist of apparel, pharma, chemicals, vehicles and furniture. However, except for a few sectors such as pharma, fish/sea creatures and carpets, exports from China are several times more than that of India.

As per our estimates, out of 1200-odd categories (HS-4 digit commodity classification) in which India exports to the US, there are 720 items where China caters to at least 10 percent of US imports. The point we want to emphasise is that the breadth of opportunity for India is huge. Even if 5 percent of US imports shift from China to India in these categories, the opportunity size is $140 billion.

Table: Exports to the USA

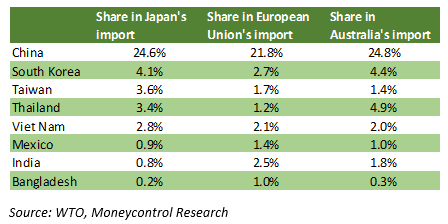

If we look at countries beyond the US, China’s wallet share in the imports of countries such as Japan, Australia and European Union ranges from 22-25 percent. The gap between India and China in these markets is a bit higher. And so notwithstanding competition from Korea and Taiwan (high value-added products), and Vietnam, Bangladesh and Thailand (lower-end products), opportunity is huge.

Table: Individual countries share in import to Japan, EU & Australia

Having said that there are multiple sectoral opportunities which investors can keep an eye on:

Chemicals: Sub-segments such as aromatic chemicals, fluorochemicals dyes & pigments and contract research and manufacturing services (CRAMS) /Contract manufacturing are expected to continue to benefit from this trend. In recent times business inquiries from developed markets have increased with the intention of diversification of supply chain. Time and again, such opportunities have been called out by the likes of NOCIL, Aarti industries and Atul industries. One of the ways this opportunity can express is with multi-year dedicated deals as exhibited by Aarti Industries and Navin Fluorine.

Agrochemicals: UPL, PI Industries, Bharat Rasayan, Excel Industries, Insecticides India are the names that are positioned to benefit from the shift and would be worth watching out for. PI Industries indicated that it has witnessed big order wins and a significant surge in enquiries and is ready for high growth in the CSM (Custom Synthesis Manufacturing) segment. UPL, another major player in this space, sees this as an opportunity to seize market share and the management believes that there is opportunity for UPL to emerge as an alternative supply source.

Pharma/APIs: On the API space, companies which appear to be well positioned given the wide portfolio are Laurus Labs, Solara Active, Ipca labs and Divi’s Lab. Divi’s Lab has recently completed Rs 1700 crore expansion plan and as 60 percent of business comes from CRAMS. It can further enhance its position as a global sourcing partner. Further, Fermenta Biotech which has a significant market share in the Vitamin D3 API can benefit as it competes with Chinese players in the global market.

In the formulation space, companies such as Cipla, Dr Reddy’s, Cadila Health having a reasonable export exposure particularly in the USA market and demands attention. Further, companies better positioned for complex generics such Biocon, Lupin and Dr Reddy’s should also be kept on a close watch.

Durables: Traction for contract manufacturers is a likely fall out of reduced import dependency. Last year, contract manufacturer Dixon Technologies had indicated the company is looking to scale up its presence in the export market through the lighting and mobiles segment. Likewise, AC manufacturer Amber Enterprises could also benefit from the market opportunities thrown across by the pandemic.

Auto component makers: Many companies associated with making components are expected to gain. In the Electricals segment, Nippon Electricals is a key player. In suspension & braking part, Jamna Auto, Gabriel India, Munjal Showa are the companies which are expected to benefit and in the cooling systems category, Subros is expected to hog the limelight.

Capital goods: MNCs with the technological advantage and strong parentage in global markets, such as Cummins, ABB and Siemens with reasonable export exposure to benefit.

Overall, this global reset of supply chains is expected to bring a varied response from Indian companies, depending on their individual strengths. The overriding objective of the customers is to reduce their supply chain risk. To that extent, the driver of this new phase of globalisation, unlike the one seen in the first decade of the 21st century, is to thrive on “reliability” rather than “cost economics”. We may see a wave of efforts across sectors aiming at backward integration and import substitution. We are also likely to witness immense export opportunities as the global supply sourcing diversifies.

Having said that there is a big asking rate for factor market reforms and competition of other destinations in Asia (Vietnam, Indonesia, and Bangladesh) which Indian policy makers and corporate India got to closely watch.

For more research articles, visit our Moneycontrol Research page

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!