Anubhav SahuMoneycontrol Research

Highlights:

-Pricing led growth on subdued volumes

-Impacted by methanol price volatility

-FY19 volume guidance downgraded-FY20 guidance intact on ramp-up in subsidiary business

Balaji Amines Q3 result was impacted by volatility in raw material prices causing a collateral damage to sales volume as the clients preferred to remain conservative on buying.

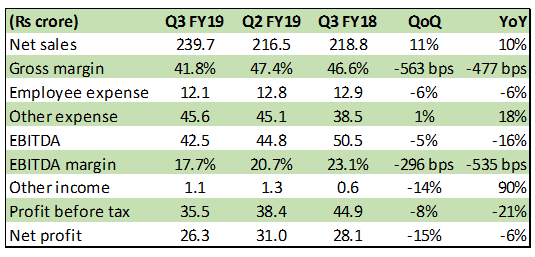

Chart: Q3 financials

Source: Company

Key positive

Q3 sales increased 9.5 percent year-on-year (YoY) aided by pricing growth. Sequential improvement was on account of soft base as Q2 was impacted by logistics challenges and a port strike.

Key concerns

EBITDA margin contracted in Q3 due to 23 percent sequential jump in input cost.

Volume growth was flattish in the quarter. The company expects gradual improvement in future as the raw material volatility settles.

The plant of the company’s subsidiary (55 percent share), Balaji Speciality chemicals is ready but wild life environmental clearance is pending. The comapny hopes this to be resolved within a month implying a delay in commissioning by a quarter.

Through this subsidiary, the company gets an exposure to specialty chemicals like ethylene diamine (22,000 tonne). Key application for ethylene diamine is in the field of fungicide like Mancozeb. It is noteworthy that India imports about 29,000 tonne ethylene diamine (EDA) every year. Among the domestic likely clients for EDA are Coromandel, UPL and Indofil. Coromandel has recently added a 10,000 tonne capacity in the Mancozeb segment taking the total installed capacity to 45,000 tonne.

Key observations

Huge volatility in Methanol during the quarter gone by remains the key concern not only for the company but for the industry dependent on methanol. Planned shutdown by one of the largest suppliers from Iran led to supply shortages. Further, price volatility in methanol is quite high. And so on account of pass through of cost there is high volatility in end products prices as well. As a result, there is a conservative buying from clients with deals more on spot basis.

There is also difficulty in financing transactions from Iran. Though at this point the US stance on Iran trade sanctions in terms of trade sanctions could also be on play. However, industry seems to awaiting clarifications from the Indian authorities. In case there are issues related to sourcing methanol from Iran, Balaji Amines seems positioned to source it from other countries (Qatar, Saudi Arabia) though there could be a higher pricing delta of 5-6 percent.

Attractive pricing levels to consider entry

A disappointing Q3 has led the company to downward revise its volume guidance for FY19. Accordingly, we have downward adjusted the topline for the next year as well and expect that EBITDA margins to settle at 19 percent.

The company’s subsidiary (55 percent stake) is expected to add Rs 300-400 crore of revenue in FY20. On a longer term, we remain positive on company’s strategy on new product capacities (Greenfield project: revenue potential of Rs 450 crore in FY23), import substitution strategy along with strong technical execution capabilities. We also take solace from the fact that demand in end markets in which company operate are stable.

Currently, the stock trades at 45 percent below its 52-week high (10.4x FY20e earnings) which is at a sharp discount to its peers providing opportunities to accumulate in near term.

Follow @anubhavsays

(Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here.)

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!