Benchmark indices failed to hold on to their their opening gains on May 26 and ended marginally lower with Sensex closing the day with a loss of 63 pointsat 30,609.30 and Nifty settling 10 points lower at 9,029.05.

"It is a short week and the focus would remain on the earnings announcements. We feel the upcoming derivatives expiry will keep the participants on their toes. We reiterate our cautious view and suggest keeping a close watch on the banking index for cues. Nifty should see a decisive break from the prevailing range of 9,000-9,200 for any directional move," Ajit Mishra, VP - Research, Religare Broking.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance level for Nifty

According to pivot charts, the key support level for Nifty is placed at 8,963.25, followed by 8,897.45. If the index moves up, key resistance levels to watch out for are 9,128.25 and 9,227.45.

Nifty Bank

The Nifty Bank closed 0.93 percent higher at 17,440.35. The important pivot level, which will act as crucial support for the index, is placed at 17,273.77, followed by 17,107.23. On the upside, key resistance levels are placed at 17,644.27 and 17,848.23.

Call option data

Maximum call OI of 29.58 lakh contracts was seen at 9,200 strike, which will act as crucial resistance in the May series.

This is followed by 9,500, which holds 27.10 lakh contracts, and 9,300 strikes, which has accumulated 24.17 lakh contracts.

Significant call writing was seen at the 9,200, which added nearly 13 lakh contracts, followed by 9,100 strikes that added 9.53 lakh contracts.

Call unwinding was witnessed at 8,900, which shed 80,400 contracts, followed by 8,500, which shed 30,525 contracts.

Source: MyFNO

Source: MyFNO

Put option data

Maximum put OI of 31.47 lakh contracts was seen at 9,000 strike, which will act as crucial support in the May series.

This is followed by 8,500, which holds 27.9 lakh contracts, and 8,800 strikes, which has accumulated 19.68 lakh contracts.

Significant Put writing was seen at 8,700, which added 3.19 lakh contracts, followed by 9,100 strikes, which added 2.47 lakh contracts.

Put unwinding was seen at 8,800, which shed nearly 2 lakh contracts, followed by 9,000 strikes that shed 1.29 lakh contracts.

Source: MyFNO

Source: MyFNO

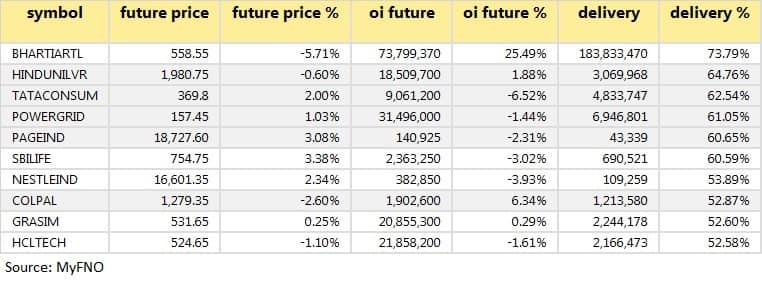

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

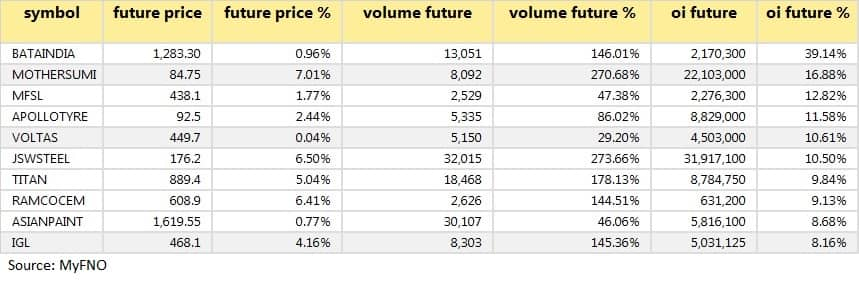

47 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

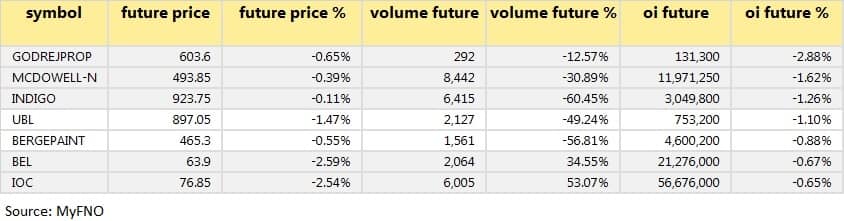

28 stocks saw long unwinding

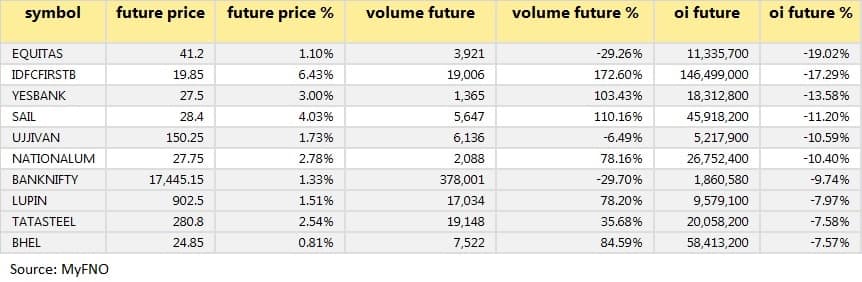

Based on OI future percentage, here are the top 10 stocks in which long unwinding was seen.

19 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

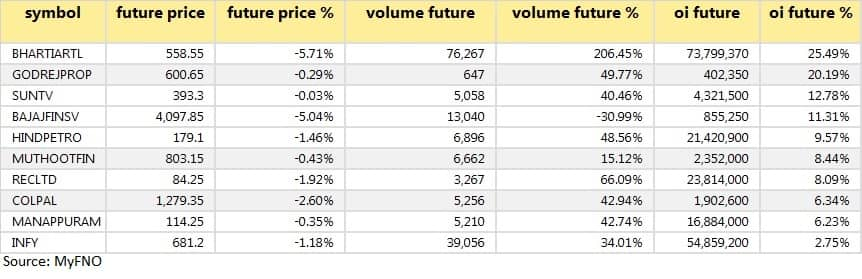

52 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

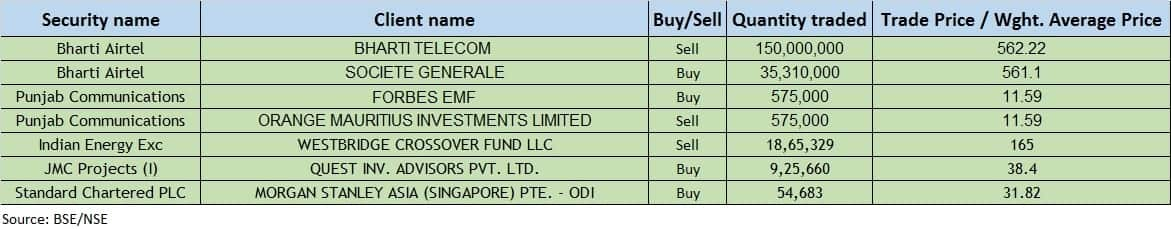

Bulk deals

(For more bulk deals, click here)

Results on May 27

Sun Pharmaceutical, Dabur India, Ujjivan Financial Services, Aditya Birla Fashion, Vaibhav Global, Tube Investments, Tata Investment Corporation, Rane Holdings, Saksoft, Quess Corp, KPIT Technologies, United Spirits, JSW Holdings, Jaiprakash Associates, India Grid Trust, Heritage Foods, Compucom Software, Foseco India

Stocks in the news

Indian Energy Exchange: Westbridge Crossover Fund LLC sold 18,65,329 shares at Rs 165 per share.

JMC Projects: Quest Investment Advisors bought 9,25,660 shares at Rs 38.4 per share.

Deepak Nitrite Q4: Profit rose to Rs 172.30 cr versus Rs 91.46 cr, revenue rose to Rs 1,055.54 cr, versus Rs 1,008 cr YoY.

SH Kelkar Q4: Profit at Rs 12.02 cr versus Rs 20.15 cr, revenue at Rs 271.16 cr versus Rs 269.74 cr YoY.

Lloyds Metals and Energy: Brickwork reaffirmed rating of banks fund based loan facilities (long term) as BBB-/Stable.

Hind Rectifiers: Company resumed full manufacturing operations at Dehradun plant.

Kewal Kiran Clothing Q4: Profit at Rs 15.76 cr versus Rs 20.12 cr, revenue at Rs 126.64 cr versus Rs 133.34 cr YoY.

VIP Industries Q4: Profit at Rs 9.52 cr versus Rs 25.28 cr, revenue at Rs 311.34 cr versus Rs 434.98 cr YoY.

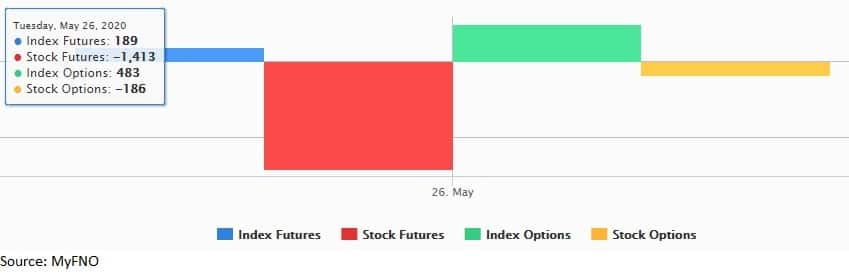

Fund flow

FII and DII data

Foreign institutional investors (FIIs) bought shares worth Rs 4,716.13 crore, while domestic institutional investors (DIIs), too, bought shares worth Rs 2,841.09 crore in the Indian equity market on May 26, provisional data available on the NSE showed.

Stock under F&O ban on NSE

No stock is under the F&O ban for May 27. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!