Headline indices -- Sensex and Nifty -- ended lower on June 29 amid mixed global cues as surging coronavirus cases around the world threatened to derail economic recovery hopes.

The Sensex ended 210 points, or 0.6 percent, down to 34,961.52 and the Nifty finished 71 points, or 0.68 percent, lower at 10,312.40.

"With states in India set to extend lockdown or reconsidering bringing back lockdown measures, the market seem to be weighing the bad news. As before, the uptrend remains intact, but the upside may be capped," Vinod Nair, Head of Research at Geojit Financial Services, said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- months data and not of the current month only.

Key support and resistance level for the Nifty

According to pivot charts, the key support level for the Nifty is placed at 10,244.67, followed by 10,176.93. If the index moves up, the key resistance levels to watch out for are 10,359.07 and 10,405.73.

Nifty Bank

The Nifty Bank index closed 1.08 percent lower at 21,359 on June 29. The important pivot level, which will act as crucial support for the index, is placed at 21,110.23, followed by 20,861.47. On the upside, key resistance levels are placed at 21,523.93 and 21,688.87.

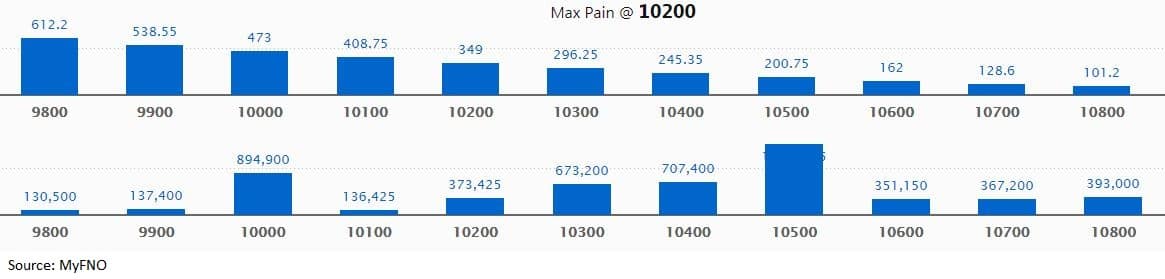

Call option data

Maximum call OI of 15.10 lakh contracts was seen at 10,500 strike, which will act as crucial resistance in the July series.

This is followed by 10,000, which holds 8.95 lakh contracts, and 10,400 strikes, which has accumulated 7.07 lakh contracts.

Significant call writing was seen at the 10,400, which added 1.49 lakh contracts, followed by 10,600 strikes which added 63,075 contracts.

Call unwinding was witnessed at 10,500, which shed 76,350 contracts, followed by 10,000, which shed 31,050 contracts.

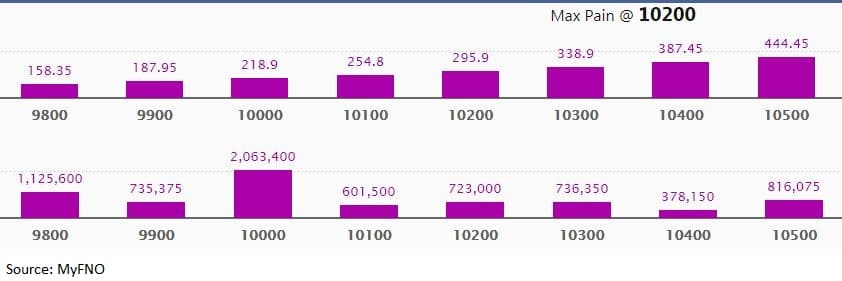

Put option data

Maximum put OI of 20.63 lakh contracts was seen at 10,000 strike, which will act as crucial support in the July series.

This is followed by 9,800, which holds 11.26 lakh contracts, and 10,500 strikes, which has accumulated 8.16 lakh contracts.

Significant put writing was seen at 10,000, which added 1.41 lakh contracts, followed by 9,900 strikes, which added 79,275 contracts.

Put unwinding was seen at 9,800, which shed 98,025 contracts, followed by 10,500 strikes, which shed 70,275 contracts.

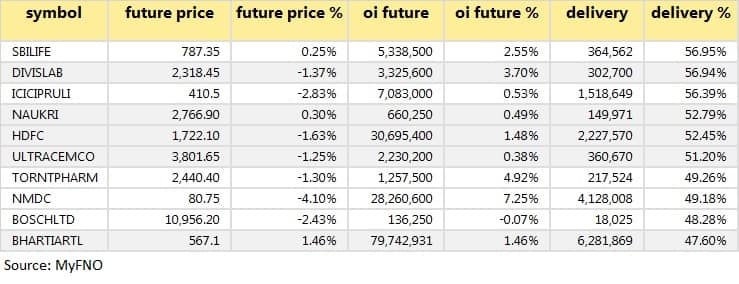

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

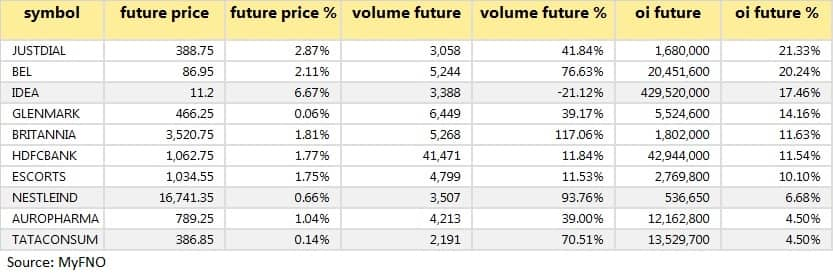

22 stocks saw long build-up

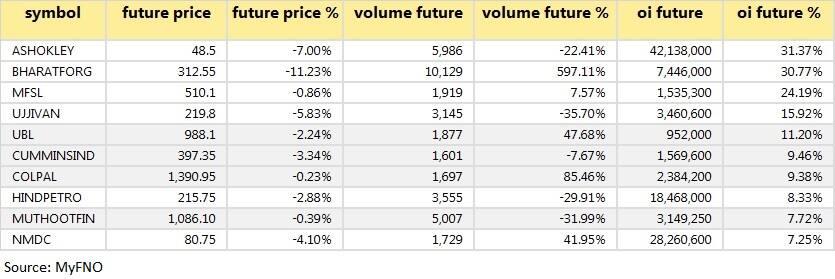

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

50 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

66 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

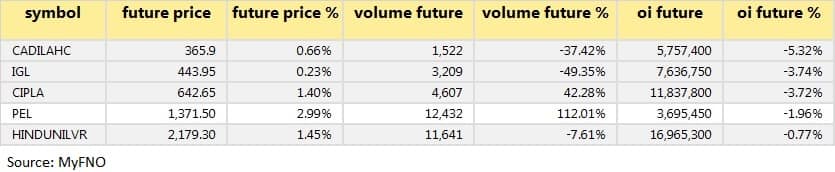

5 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering.

Bulk deals (For more bulk deals, click here)

(For more bulk deals, click here)

Results on June 30ONGC, Vodafone Idea, NBCC, RITES, Shalimar Paints, Deepak Fertilisers, Godfrey Phillips, ICRA, Mishra Dhatu Nigam, The New India Assurance Company, etc.

Stocks in the newsGAIL: Fitch affirmed the company's long-term foreign-currency issuer default rating (IDR) at BBB-. The outlook is negative.

Orient Refractories: Q4 profit at Rs 18.5 crore versus Rs 25 crore, revenue at Rs 162.4 crore versus Rs 187.4 crore YoY.

Minda Industries: Q4 profit at Rs 7.3 crore versus Rs 73.5 crore, revenue at Rs 1,339 crore versus Rs 1,486.5 crore YoY.

Central Bank of India: Q4 loss at Rs 1,529 crore versus a loss of Rs 2,477.4 crore, net interest income (NII) at Rs 1,925.8 crore versus Rs 1,602.5 crore YoY.

Bharti Airtel added 9.2 lakh users in February as against 8.5 lakh additional users in January.

Tata Power: Board will consider raising funds via equity and debt on July 2.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 1,937.06 crore, while domestic institutional investors (DIIs) bought shares worth Rs 1,036.13 crore in the Indian equity market on June 29, provisional data available on the NSE showed.

Stock under F&O ban on NSE

There is no stock under the F&O ban for June 30. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!