Nifty continued its northward march for the third day in a row to close at 10,311 levels, the highest since March 11, despite weak global cues.

Sensex closed 180 points, or 0.52 percent, higher at 34,911.32 while Nifty finished at 10,311.20, up 67 points, or 0.65 percent.

"Markets have been showing resilience despite mixed local cues and it may extend further if the buoyancy on the global front continues. Meanwhile, investors would continue to keep a watch on the India-China standoff and COVID-19 situation. At the same time, earnings announcements and upcoming derivatives expiry would keep the volatility high. Traders should limit their leveraged positions and continue their focus on stock selection," said Ajit Mishra, VP - Research, Religare Broking.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance level for the Nifty

According to pivot charts, the key support level for the Nifty is placed at 10,261.3, followed by 10,211.4. If the index moves up, the key resistance levels to watch out for are 10,377.4 and 10,443.6.

Nifty Bank

The Nifty Bank closed 1.74 percent higher at 21,708.35. The important pivot level, which will act as crucial support for the index, is placed at 21,396.53, followed by 21,084.77. On the upside, key resistance levels are placed at 22,049.13 and 22,389.96.

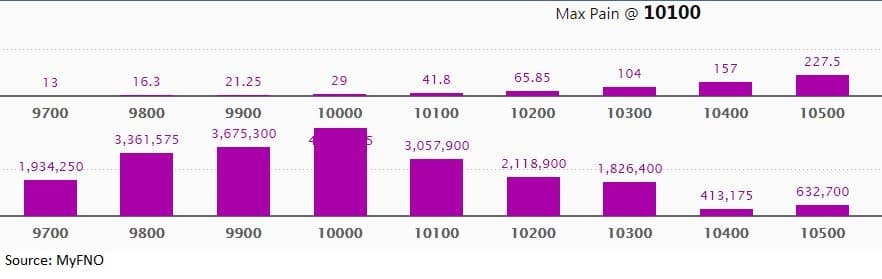

Call option data

Maximum call OI of 37.04 lakh contracts was seen at 10,500 strike, which will act as crucial resistance in the June series.

This is followed by 10,300, which holds 26.73 lakh contracts, and 10,400 strikes, which has accumulated 25.01 lakh contracts.

Significant call writing was seen at the 10,600, which added 4.9 lakh contracts, followed by 10,700 strikes which added 2.7 lakh contracts and 10,500 strike which added 2.6 lakh contracts.

Call unwinding was witnessed at 10,200, which shed 4.09 lakh contracts, followed by 10,000 strikes, which shed 2.24 lakh contracts.

Put option data

Maximum put OI of 46.76 lakh contracts was seen at 10,000 strike, which will act as crucial support in the June series.

This is followed by 9,900, which holds 36.75 lakh contracts, and 9,800 strikes, which has accumulated 33.62 lakh contracts.

Significant put writing was seen at 10,100, which added 13.42 lakh contracts, followed by 10,200 strikes, which added 10.44 lakh contracts.

Put unwinding was seen at 9,700, which shed 1.22 lakh contracts, followed by 9,900 strike which shed 95,700 contracts.

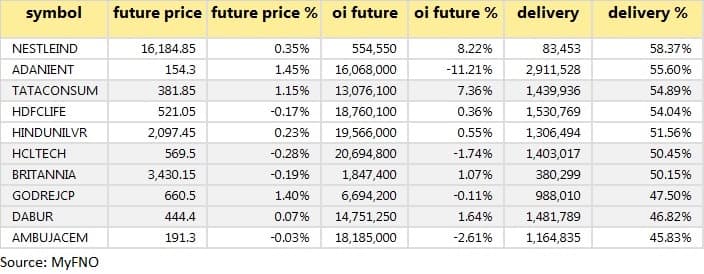

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

65 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

13 stocks saw long unwinding

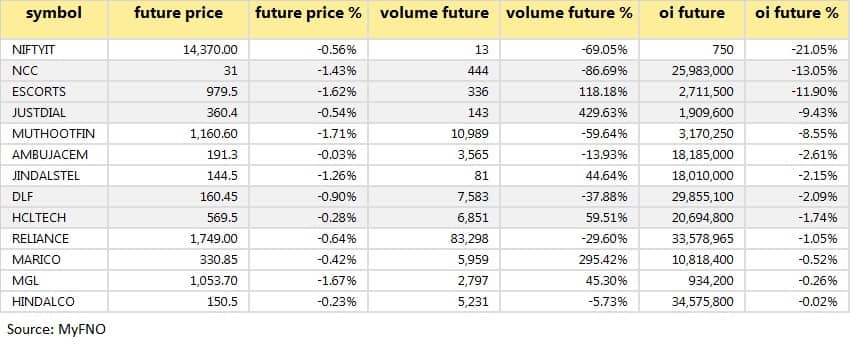

25 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

42 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

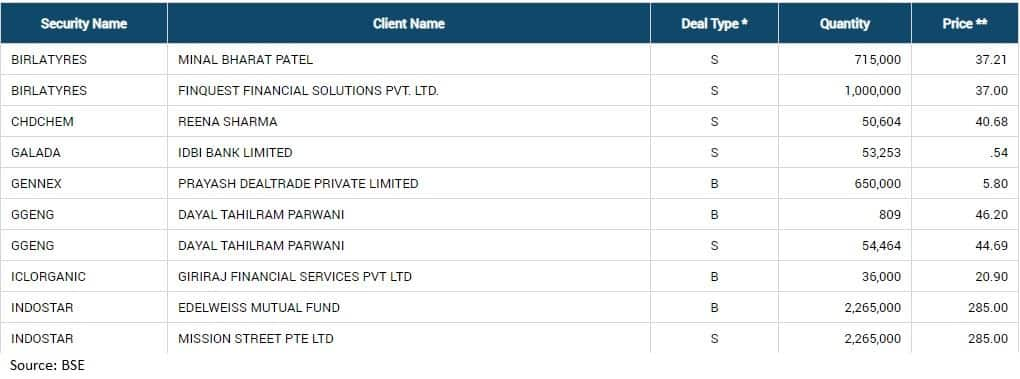

Bulk deals

(For more bulk deals, click here)

Results on June 23

Asian Paints, Bank of Baroda, Union Bank of India, Berger Paints, Aster DM Healthcare, Ador Welding, Asahi Songwon Colors, Balrampur Chini Mills, DB Corp, EIH Associated Hotels, Finolex Industries, GM Breweries, GMDC, Hatsun Agro Product, Indian Bank, Kolte-Patil Developers, Man Industries, NLC India, Page Industries, Phillips Carbon Black, Precision Camshafts, Surana Telecom, Talbros Engineering, Vardhman Textiles.

Stocks in the news

Glenmark Pharma: HSBC Pooled Asian Equity Fund sold 18,79,542 shares in the company at Rs 527.77 per share.

ICICI Prudential Life: The government of Singapore acquired 1,64,30,820 shares in the company at Rs 391.6 per share.

Indostar Capital Finance: Edelweiss MF bought 22.65 lakh shares in the company at Rs 285 per share.

Satin Creditcare Network: The board approved a rights issue of up to Rs 120 crore.

Balaji Amines Q4: Profit at Rs 30.81 cr versus Rs 26.45 cr, revenue at Rs 258 cr versus Rs 226.62 cr YoY.

Mindteck: Company won a two-year contract in the Middle East.

Skipper Q4: Profit at Rs 28.12 cr versus Rs 17.75 cr, revenue at Rs 438.85 cr versus Rs 433.4 cr YoY.

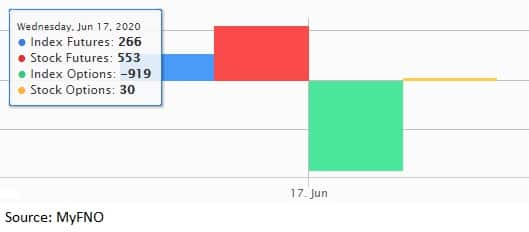

Fund flow

FII and DII data

Foreign institutional investors (FIIs) bought shares worth Rs 424.21 crore, while domestic institutional investors (DIIs) sold shares worth Rs 1,287.69 crore in the Indian equity market on June 22, provisional data available on the NSE showed.

Stock under F&O ban on NSE

Five stocks - Century Textiles & Industries, Escorts, Vodafone Idea, Jindal Steel and NCC - are under the F&O ban for June 23. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!