Key indices -- Sensex and Nifty -- ended with healthy gains on June 10 amid mixed global cues awaiting announcements from the Federal Open Market Committee (FOMC) scheduled for later today (June 10).

The Sensex ended the day with a gain of 290 points, or 0.86 percent, at 34,247.05. The Nifty settled 70 points, or 0.69 percent, higher at 10,116.15.

In sync with the benchmarks, BSE Midcap and Smallcap indices closed 0.81 percent and 0.92 percent up, respectively.

"Although the US Federal Reserve is expected to maintain status quo, the market will be looking out for any hints, which could impact it, and the direction: depending on whether it is hawkish or dovish in tone. We would suggest increasing allocation in quality names," said Vinod Nair, Head of Research at Geojit Financial Services.

“Markets have been consolidating in the range of 10,000-10,300 for the past few trading sessions. The midcap space witnessed build-up in momentum and we expect the same to continue. Currently, all data parameters suggest buying on dips. On the sectoral front, we expect banking and metal stocks to lead while positive trends are seen in the auto and commodity space,” said Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance level for the Nifty

According to pivot charts, the key support level for the Nifty is placed at 10,052.4, followed by 9,988.6. If the index moves up, the key resistance levels to watch out for are 10,164.4 and 10,212.6.

Nifty Bank

The Nifty Bank closed 1.81 percent higher at 21,100.10. The important pivot level, which will act as crucial support for the index, is placed at 20,764, followed by 20,427.9. On the upside, key resistance levels are placed at 21,343.8 and 21,587.5.

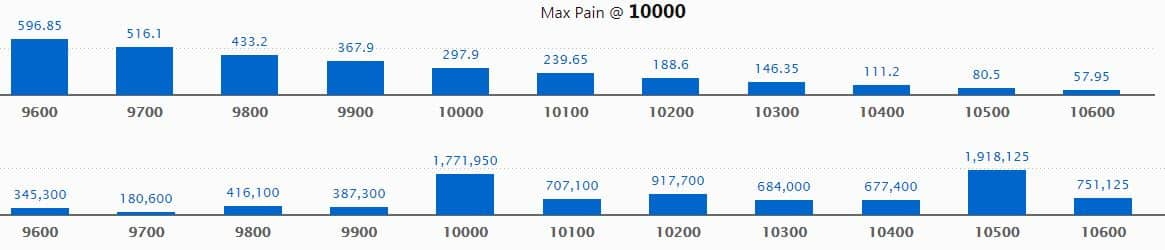

Call option data

Maximum call OI of 19.18 lakh contracts was seen at 10,500 strike, which will act as crucial resistance in the June series.

This is followed by 10,000, which holds 17.72 lakh contracts, and 10,200 strikes, which has accumulated 9.18 lakh contracts.

Significant call writing was seen at the 10,100, which added 1.94 lakh contracts, followed by 10,500 strikes that added 1.75 lakh contracts.

Call unwinding was witnessed at 10,300, which shed 61,200 contracts, followed by 9,900 strikes, which shed 13,875 contracts.

Source: MyFNO

Source: MyFNO

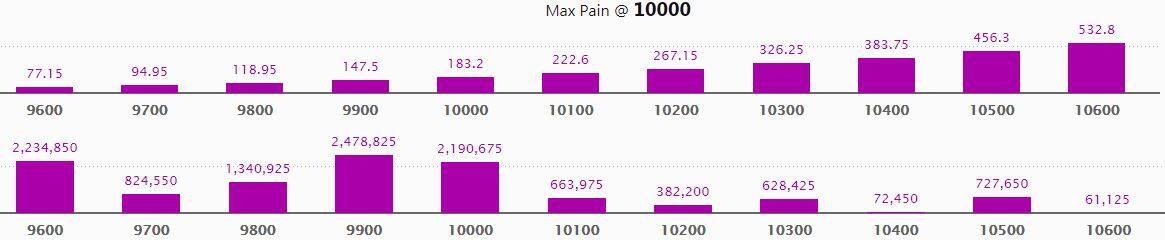

Put option data

Maximum put OI of 24.79 lakh contracts was seen at 9,900 strike, which will act as crucial support in the June series.

This is followed by 9,600, which holds 22.35 lakh contracts, and 10,000 strikes, which has accumulated 21.91 lakh contracts.

Significant put writing was seen at 9,800, which added 69,300 contracts, followed by 10,100 strikes, which added 64,800 contracts.

Put unwinding was seen at 9,900, which shed 78,675 contracts, followed by 10,300 strikes, which shed 34,575 contracts.

Source: MyFNO

Source: MyFNO

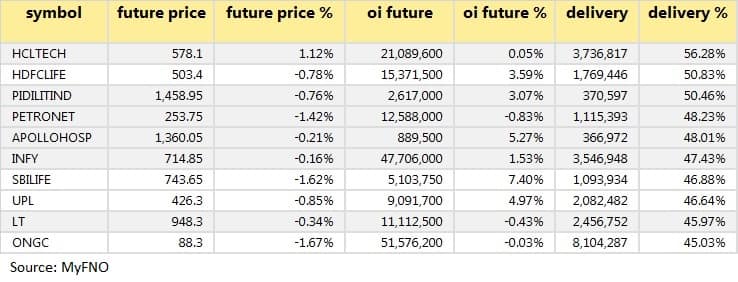

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

51 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

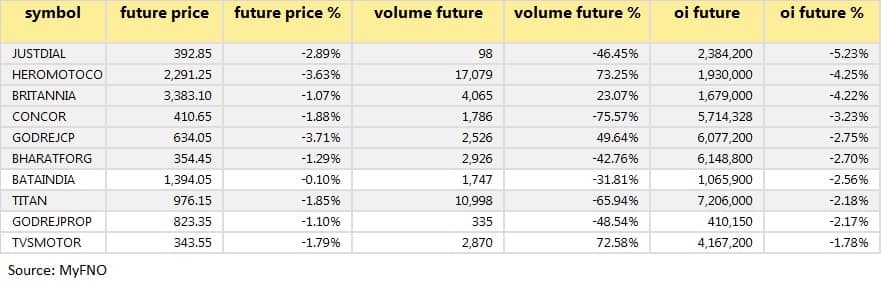

21 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

33 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

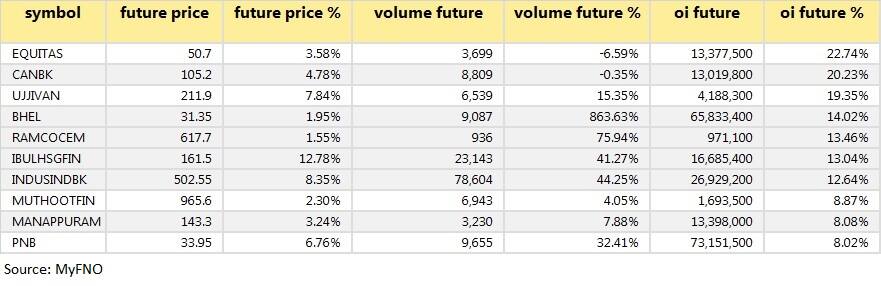

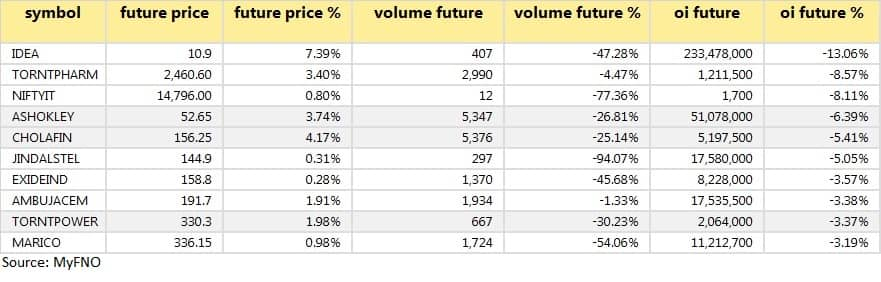

39 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

(For more bulk deals, click here)

Results on June 11Allied Digital Services, Banco Products (India), DIC India, Dixon Technologies, EID Parry, Enkei Wheels, Foods & Inns, IIFL Wealth Management, KNR Constructions, KSB, Redington India, Shriram City Union Finance, Sundram Fasteners, Take Solutions and Westlife Development.

Stocks in the newsRamco Systems: Vijay Kishanlal Kedia bought 3,39,843 shares at Rs 87.82 per share.

Aarey Drugs: LTS Investment Fund further sold 5,15,000 shares in the company at Rs 19.00 per share.

Shree Cement: CARE reaffirmed rating for the company's commercial papers at A1+.

Shriram Transport Finance Q4: Profit at Rs 224.35 crore versus Rs 749 crore, revenue at Rs 4,168.4 crore versus Rs 3,873 crore YoY.

HSIL Q4: Profit at Rs 3.38 crore versus Rs 33.53 crore, revenue at Rs 461 crore versus Rs 471.5 crore YoY.

Tanla Solutions Q4: Loss at Rs 89.13 crore versus profit at Rs 9.73 crore, revenue at Rs 522 crore versus Rs 318 crore YoY.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 919.26 crore, while domestic institutional investors (DIIs) bought shares worth Rs 500.7 crore in the Indian equity market on June 10, provisional data available on the NSE showed.

Stock under F&O ban on NSE

Six stocks - BHEL, Vodafone Idea, Jindal Steel, Just Dial, NCC and PVR - are under the F&O ban for June 11. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!