Extending their winning streak to the sixth consecutive session, benchmark indices Sensex and Nifty on June 3 settled with decent gains despite some profit-booking at the fag end.

Sensex ended 284 points higher at 34,109.54 while Nifty closed 82 points up at 10,061.55.

The BSE Midcap and Smallcap indices closed 0.31 percent and 1.24 percent higher, respectively.

"Markets are currently riding on the global buoyancy but the profit-taking in the last hour and scheduled weekly expiry indicate the possibility of a pause on Thursday, June 4. The benchmark may take a breather and see some consolidation before the further surge. Meanwhile, there will be no shortage of opportunity on the stock-specific front so plan your trades accordingly," said Ajit Mishra, VP - Research, Religare Broking.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance level for Nifty

According to pivot charts, the key support level for Nifty is placed at 10,005.93, followed by 9,950.37. If the index moves up, key resistance levels to watch out for are 10,146.63 and 10,231.77.

Nifty Bank

The Nifty Bank index closed 2 percent higher at 20,940.70. The important pivot level, which will act as crucial support for the index, is placed at 20,635.27, followed by 20,329.83. On the upside, key resistance levels are placed at 21,432.87 and 21,925.03.

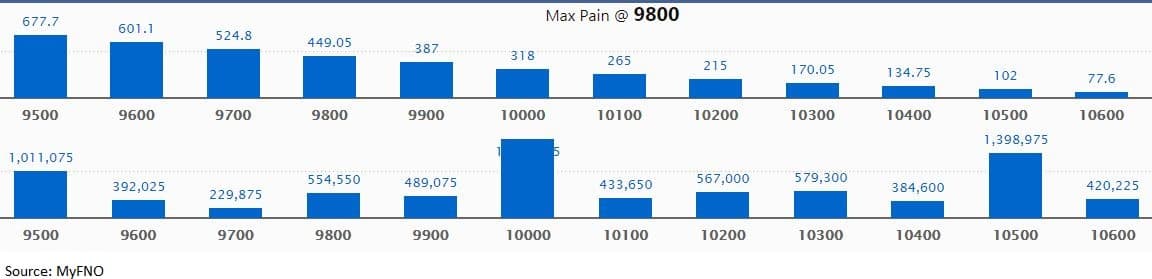

Call option data

Maximum call OI of 16.88 lakh contracts was seen at 10,000 strike, which will act as crucial resistance in the June series.

This is followed by 10,500, which holds nearly 14 lakh contracts, and 9,500 strikes, which has accumulated 10.11 lakh contracts.

Significant call writing was seen at the 10,300, which added 2.22 lakh contracts, followed by 10,100 strikes that added 1.52 lakh contracts.

Call unwinding was witnessed at 10,000, which shed 1.56 lakh contracts, followed by 9,900 strike which shed 90,375 contracts.

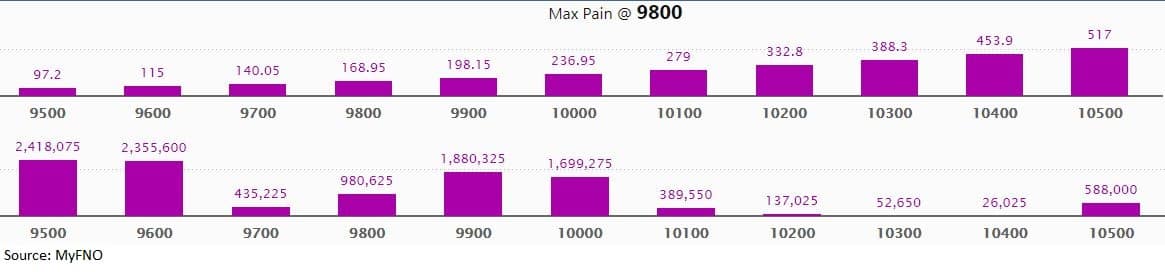

Put option data

Maximum put OI of 24.18 lakh contracts was seen at 9,500 strike, which will act as crucial support in the June series.

This is followed by 9,600, which holds 23.56 lakh contracts, and 9,900 strikes, which has accumulated 18.80 lakh contracts.

Significant put writing was seen at 9,600, which added 5.75 lakh contracts, followed by 10,000 strikes, which added 4.84 lakh contracts.

Put unwinding was seen at 10,500, which shed 14,925 contracts.

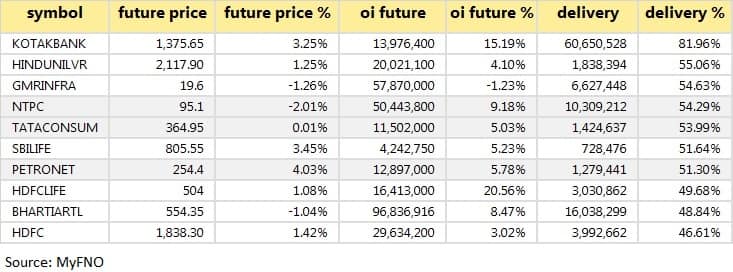

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

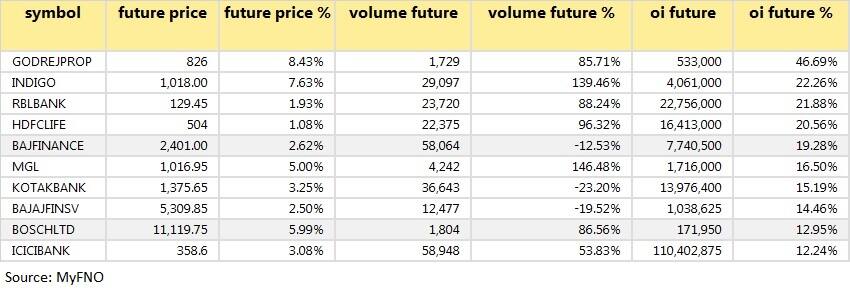

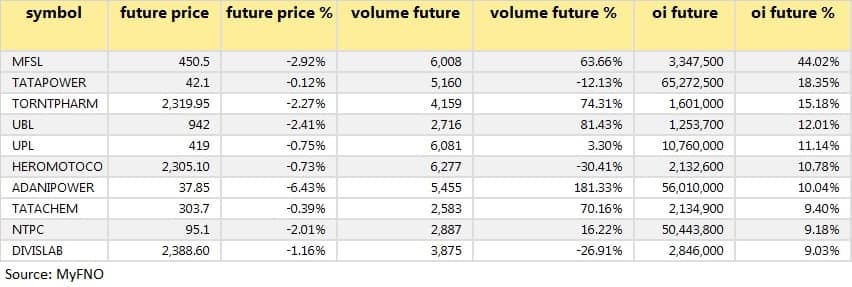

77 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

11 stocks saw long unwinding

48 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

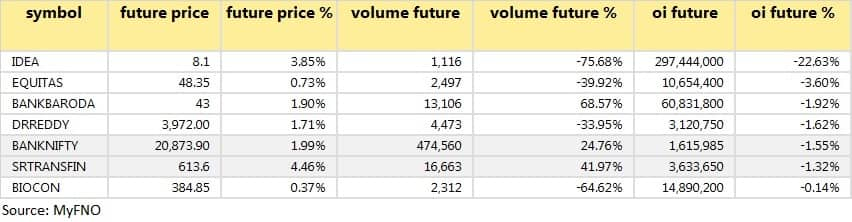

7 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering.

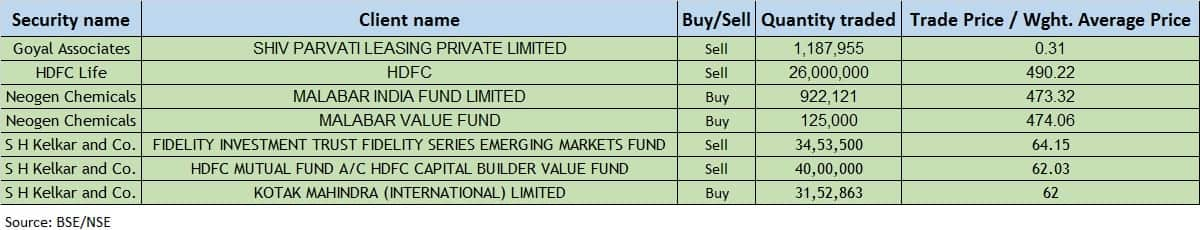

Bulk deals

(For more bulk deals, click here)

Results on June 4

DLF, PI Industries, NIIT, PNB Gilts, SRF, Chemfab Alkalis, Cosmo Films, Filatex India, Igarashi Motors India, IL&FS Transportation Networks, LKP Securities, Safari Industries, TD Power Systems, Tourism Finance Corporation

Stocks in the news

HDFC Life: Promoter HDFC sold 2.6 crore shares in the company at Rs 490.22 per share.

Neogen Chemicals: Haridas Thakarshi Kanani and his wife Beena Kanani sold a 4.82 percent stake in the company.

SREI Infrastructure: Fidelity Investment Trust Fidelity Series Emerging Markets Fund sold 54,00,000 shares in company at Rs 5.05 per share.

BPCL Q4: Loss at Rs 1847.37 cr versus profit at Rs 2,912 cr, revenue at Rs 81,829.6 cr versus Rs 84,791.88 cr YoY.

Aurobindo Pharma Q4: Profit at Rs 849.83 cr versus Rs 585.38 cr, revenue at Rs 6,158.43 cr versus Rs 5,292.20 cr YoY.

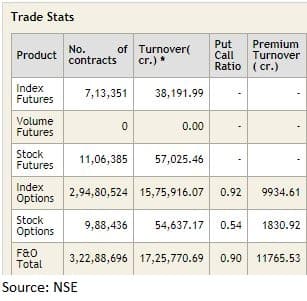

Fund flow

FII and DII data

Foreign institutional investors (FIIs) bought shares worth Rs 1,851.12 crore, while domestic institutional investors (DIIs) sold shares worth Rs 781.79 crore in the Indian equity market on June 3, provisional data available on the NSE showed.

Stock under F&O ban on NSE

No stock is under the F&O ban for June 4. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!