Finding opportunities in a volatile market will always be tough, but as the wisdom goes in the market, there are always opportunities in every adversity which exhibit bull moves even in a rough environment, ICICIdirect said in a report.

In the current uncertain scenario, when many stocks are at multi-year lows and finding opportunities is challenging, identifying such resilient stocks and riding them in a rough environment like this will be rewarding and exciting.

ICICIdirect, in its latest report, handpicked resilient Mid-caps and Small-caps where it can capture higher beta.

Why mid & small-caps?

The brokerage firm is of the view that the mid-cap and the small-cap segment is at the cusp of the next major bull market signalling their outperformance ahead. Investors should pick quality stocks in the segment, it said.

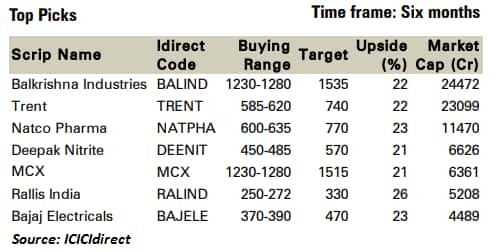

Stocks which are looking attractive are Balkrishna Industries, Trent, Natco Pharma, Deepak Nitrite, MCX, Rallis India and Bajaj Electricals.

Here are some of the factors why small & mid-caps are likely to do well:

a) Nifty Midcap and Nifty small-cap indices have undergone significant price correction (51% and 67% respectively from 2018 high) while time wise current decline has consumed 26 months (no bear market in two decades lasted for more than 19 months (CY2000-2001))

This significant price/time correction has helped indices to work out of the excesses built-in bull market of 2014-2017 and most negatives now seem priced in, offering favourable risk-reward setup

b) The relative ratio of Mid and small-cap indices/ Nifty is at cyclical lows and now turning up, signifying outperformance ahead after a two-year bear phase

C) Sentiment as represented by 14-month RSI (momentum oscillator) <35, is a a major cycle low, last observed in CY08 and CY13. In both instances, such readings have laid the foundation of the next major bull market.

D) Structurally, current rally from March 2020 lows is highest quarterly gain since 2014 and sharpest in magnitude since the 2018 peaks indicating structural turnaround, while a positive thrust in market breadth and expanding volumes, gives us confidence that worst is behind us.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!