The Nifty50 traded well above 10,200 levels intraday on June 22, a level first time witnessed in October 2017. During this period, the index has seen major ups and downs, as well as a lot of change in constituents in terms of relative performance.

Events like US-China trade tension, volatile economic and earnings growth, NBFC crisis, asset quality concerns, fall in interest rates, BJP's second win in general elections, economic and financial reforms, nationwide lockdown to control the virus etc took place during the abovementioned period.

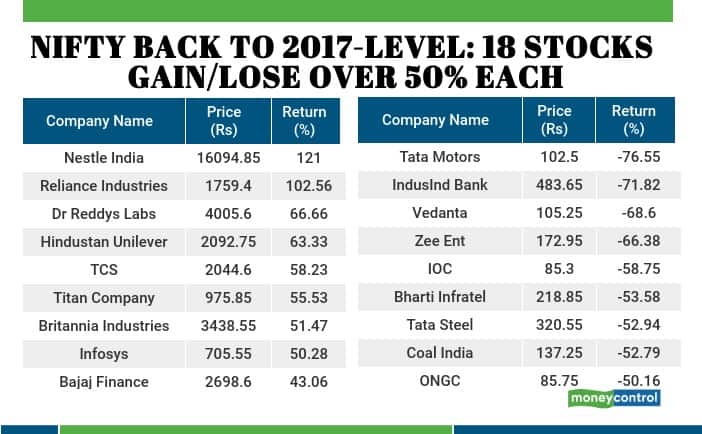

In the time Nifty50 rallied from 10,200 in October 2017 to over 12,400 in January 2020, and back to 10,200 again, two stocks in the 50-stock Kitty more than doubled while nine stocks have fallen more than 50 percent.

Nestle India, the milk products and other food products maker, was the top stock which gained 121 percent during this period. The major upside came especially after the company regained the market share of Maggi. Consistent earnings growth also fueled the stock.

Billionaire Mukesh Ambani-owned Reliance Industries was at the second spot with 103 percent gains. The strong performance of its telecom business after tariff hikes, fundraising by Jio Platforms along with the company turning net debt-free (last week) well ahead of the target of March 2021 were key reasons behind the rally in stock price.

Also Read: Rerating candidate! RIL becomes 1st Indian company to hit m-cap of $150 billion

Among others, Dr Reddy's Laboratories, Hindustan Unilever, Tata Consultancy Services, Titan Company, Britannia Industries and Infosys rallied 50-66 percent.

On the other side, Tata Motors, IndusInd Bank, Vedanta, Zee Entertainment Enterprises, Indian Oil Corporation, Bharti Infratel, Tata Steel, Coal India and ONGC were top losers, falling more than 50 percent each.

The COVID-19 crisis-led global lockdown hit a majority of the above scrips. The market, however, seems on course for a gradual recovery with the reopening of the economy and decline in COVID-19 cases worldwide but experts feel major upside will only come after a vaccine for COVID-19 is developed.

"I think COVID-19 vaccine will be a big impetus for the Nifty to rally above 11,000 as it will ensure smooth 'U' shaped recovery for all the sectors and no risk of anymore lockdowns/slowdowns. I don't think global liquidity can take it above 11,000 in the coming weeks, but if the situation is constantly improving, we may reach 11,000 in a span of 2-3 months," Sumit Bilgaiyan, Founder of Equity99 told Moneycontrol.

Experts feel that in the near-term market will react to as and how the coronavirus situation unfolds in the country. According to them, the Sino-India issue should not have much impact on the market but nonetheless developments in that regard should be on the radar of investors.

"Main things to watch out will be the COVID-19 cases and COVID scenario in the metro cities. Indo-China resolutions will also be crucial," Bilgaiyan said.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

"Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol."

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!