Shabbir Kayyumi

What is Gann Fan?

Gann fans are a form of technical analysis based on the idea that the market is geometric and cyclical in nature. A Gann fan consists of a series of lines called Gann angles. These angles are superimposed over a price chart to show potential support and resistance levels. Gann Fan indicator draws diagonal support and resistance levels at different angles.

Gann Fans, created by W D Gann, are based on the premise that prices move in predictable patterns. Gann's theory is based on time/price movements with the 1 time unit by 1 price unit (i.e. 1 x 1) being the main angle (45-degree). However, there are other angles such as the 1 x 2, 2 x 1, 1 x 4, 4 x 1, etc. Gann Fans are drawn from major price peaks and bottoms and are used to show trend lines of support and resistance.

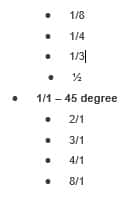

If you can spot a pattern or any other geometric shape in a chart, there is a high probability you can spot them at the Gann fan angles. We have special Gann fan angles and more specifically Gann came up with 9 different angles. The most important angle is the 45-degree angle or the 1/1 line. For every Gann angle, a line is derived from that angle. We can distinguish 4 different Gann angles above the 45-degree angle and 4 other Gann angles below, as follows:

Why to buy TVS Motor Company?

According to Gann theory, there are special angles you can draw on a chart. They will give you a good indicator of what the price is going to do in the future.

Buy signal

Gann believed that when price and time move in sync, then that's the ideal balance of the market. The biggest part of the Gann theory revolves around the fact that prices above the 1/1 line, the 45-degree line will determine a directional price movement and prices below the 1/1 line determine non-directional price movement. Couple it with distinct technical patterns like the rising wedge, or ascending broadening wedge, and it can help you determine key entry and exit points.

The Fan is started at a low or high point. The resulting lines show areas of potential future support and resistance. In case of TVS Motor we have drawn 2 Gann Fan on the chart. Looking at Gann Fan drawn from recent top of Rs 479, we can easily point out that this stock has breached 8/1 angle line indicating domination of bulls and entire bear cycle is concluded. At the same time TVS Motor is trading around 1/1 line after making a bottom of Rs 240 is clearly indicated on Gann Fan drawn using the swing bottom of Rs 240. Overall scenario is a valid setup for buy on dip in this stock. Figure.1. Gann Fan and Buy signal on TVS Motor

Figure.1. Gann Fan and Buy signal on TVS Motor

Profit Booking

As per one of the method of Gann suggests 1/1 can continue to provide resistance as long as prices are trading around it. At the same time previous swing is standing around Rs 448. So one can consider profit booking near Rs 448 and higher towards Rs 470 mark.

Stop Loss

Gann gave importance to crucial angle of 1/1 in all of his trading methods. Keeping it mind we have calculated one angle below it i.e. 2/1, which comes to Rs 350. Entire bullish view negates on a breach of 2/1 angle trend line and in case of TVS Motor, we will consider Rs 350 as a stop loss level.

Conclusion

We recommend buying TVS Motor Company around Rs 380 with a stop loss of Rs 350 for higher targets of Rs 448/470 as indicated in above chart.

The author is Head - Technical Research at Narnolia Financial Advisors.

Disclosure: Narnolia Financial Advisors/Analyst (s) does/do not have any holding in the stocks discussed but these stocks may have been recommended to clients in the past. Clients of Narnolia Financial Advisors Ltd. may be holding aforesaid stocks. The stocks recommended are based on our analysis which is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!