Bulls pushed benchmark indices above their crucial resistance levels in July but profit-taking in the last week of July capped the upside. The S&P BSE Sensex and Nifty50 rallied over 7 percent each in July but the real action was in select mid & small-cap space.

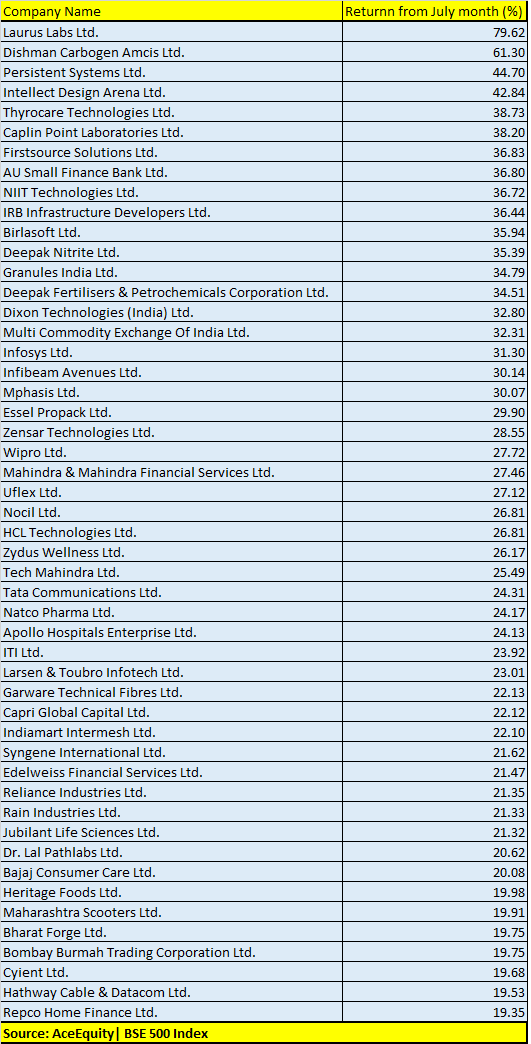

Although broader market indices i.e. the S&P BSE Small-cap index and the S&P BSE Mid-cap index closed with gains of over 5 percent each but more than 100 stocks in the BSE500 index rallied 10-80% in July.

There are as many as 126 stocks in the S&P BSE 500 index which rallied 10-80% in the month of July that include names like Cadila Healthcare, PVR, Bank of Maharashtra, M&M, Dr Lal Pathlabs, Heritage Foods, L&T Infotech, and Laurus Labs, etc. among others.

Experts are of the view that due to underperformance in the broader market space, smart buying is happening in select quality stocks. However, the right approach would be to enter this space in a staggered way rather than making a lump sum payment.

“Most frontline stocks may have risen excessively portraying high valuations but select mid and small caps are certainly not trading at high multiples, they are decently priced some even undervalued,” Umesh Mehta, Head of Research, Samco Group told Moneycontrol.

“Hence, selective buying in certain pockets of the broader markets can entice investors in their search for value. A staggered buying strategy through SIPs in fundamentally strong small and mid-cap stocks is the right approach, especially when they are trading at decent valuations but buying lump sum at current is not advisable,” he said.

Sectoral Outlook

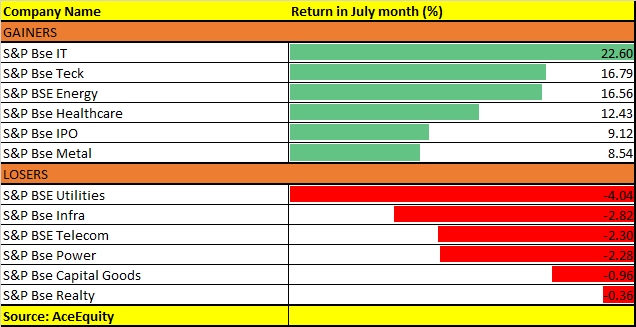

Smart buying was seen in sectors like IT, Energy, and Healthcare with all three recordings a rise of more than 10 percent each while selling pressure was visible in Infra, utilities, telecom, power, capital goods, and realty space.

“We have been maintaining a positive bias on both the sectors as they are being more of global plays i.e. IT and Pharma. Pharma has been the leader of the current up move since the start of the rally from Apr’20 after a huge underperformance over many years,” Rajeev Srivastava, Chief Business Officer at Reliance Securities told Moneycontrol.

“IT sector has picked up in the current month with one of the largest gains of 22.4% post strong results, better management commentary from the companies and lot of large order wins from global companies,” he said.

Technical Outlook:

Weakness in the heavyweights like Reliance Industries and HDFC twins drove the headline index – Nifty50 lower. The Nifty50 formed a bullish candle on the monthly charts; however, some profit-taking was seen in the last week of July.

Overall, Nifty seems to be consolidating sideways in a range as it has entered the GAP zone which was created due to the massive selloff witnessed in the March early this year.

Experts are of the view that on the upside 11300-11400 levels are likely to act as stiff resistance while on the downside 11000-11040 will act as a crucial support zone.

“On the upside 11300-11400 is the supply zone which also happens to be the upper end of the GAP area and on the downside 11040 is the demand zone. Any significant move will be witnessed on a breakout from this trading range,” Aditya Agarwala, Senior Technical Analyst - Institutional Equities, YES SECURITIES told Moneycontrol.

“Following two strong expires from the point of view of bulls, the Nifty could take a pause and may witness minor profit booking while broader markets may continue to rise,” he said.

Agarwala further added that the Nifty is facing resistance at the 78.6% retracement placed at 11400 which also happens to be the GAP area, failure to break out of this resistance may invite bears to push the Index lower to 10800. Therefore, Nifty in Aug series may trade with mild weakness.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!