With the gradual reopening of the economy and positive sentiment in the rural sector, automakers saw a mild uptick in sales in the month of June.

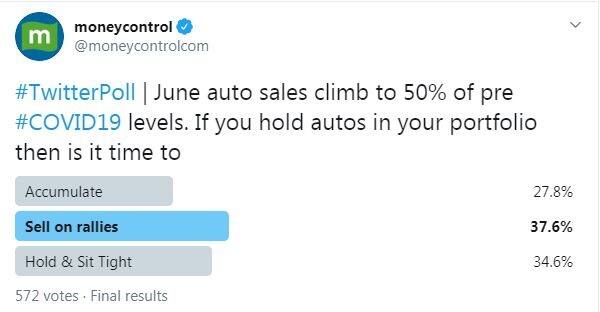

However, the uptick was sequential and on a yearly basis, the numbers are still behind. In a poll, conducted by Moneycontrol on Twitter, the majority of readers suggested 'sell on rally' for auto stocks, indicating that the outlook for the sector remains tepid.

Besides, a significant section of respondents suggested 'hold & sit tight', probably awaiting more clarity from the companies' June quarter earnings and the sales numbers of the subsequent months.

"The June 2020 demand trends are positively impacted by pent-up demand release which has likely been accentuated by demand related to marriages in North India. Thus extrapolation of June retail recovery trends into upcoming months might be flawed. The data emerging in July and August months would provide a clearer retail demand structure," said ICICI Securities.

Vehicle sales in June climbed to 50 percent of pre-COVID levels, while dealers reported a surge in online inquiries.

Unserviced bookings, pent-up demand and an increase in production are believed to be the main reasons behind the surge in June sales.

Even before the coronavirus (COVID-19) pandemic started to decimate things for the sector, it was already facing challenges due to migration from BS-4 to BS-6, regulatory norms and falling volumes.

Due to the sudden lockdown, companies reported almost zero sales in the month of April. While companies resumed operations partially in May, numbers were still very subdued with only the tractor segment reporting a decent set of numbers.

Rajit Rajoriya, Equity Research Associate, Angel Broking highlighted that with economic activities improving significantly in June due to unlock 1.0 two-wheelers and passenger vehicles (PV) segment reported strong traction.

In the commercial vehicle space, the LCV segment has started to see a recovery led primarily by rising rural demand and movement of essential goods across the country, though the demand in the MHCV space is still very muted, Rajoriya said.

While the two-wheelers and tractor may report good sales going forward driven by strong rural demand, the road for the PV segment looks hazy. This segment is also pinning its hopes on rural demand.

"In the PV segment, with large urban areas expected to remain under some form of restrictions in the near future, we expect a buoyant rural demand, which will lead to a quicker recovery in entry-level vehicle sales. However a broad-based recovery can happen only when major urban centers fully recover and return to normalcy," Rajoriya said.

Domestic commercial vehicle (CV) industry volumes remained in the slow lane, due to surplus capacity with fleet operators. The fall is higher in medium and heavy commercial vehicles (MHCVs) than light commercial vehicles (LCVs).

This segment may continue to see some pressure.

"While the commercial vehicle segment is expected to remain under pressure, LCVs are expected to do better in the coming months compared to M&HCVs," Rajoriya said.

"At the current levels, we would recommend investors to accumulate tractors and two-wheelers stocks like Escorts, Swaraj Engine and Hero Motocorp, while one should hold and sit tight on PV companies like Maruti Suzuki. Given that we expect demand for MHCV to remain muted going forward we would recommend investors avoid the space for now till there is better clarity on the demand,” Rajoriya said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!