The market surprised everyone as benchmark indices rallied for the third consecutive week which ended on July 3, despite rapid rise in COVID-19 cases.

Hopes of the economy gradually getting back on track, coupled with positive global cues, manufacturing PMI, auto sales data and progress over a vaccine against the novel coronavirus lifted sentiments.

The BSE Sensex and Nifty50 climbed over 2 percent and hit nearly four month-high during the week, taking the total three-week gains to more than 6 percent. However, broader markets with a flat close underperformed benchmark indices.

Benchmark and broader indices have surged 39-42 percent from their March 23rd's low point. This clearly indicates some exhaustion at the bulls desk. Thus, there could be some consolidation in the coming days. The market will closely watch June quarter earnings along with COVID-19 cases and global cues, experts feel.

"A tug of war between bulls and bears have now come to a grinding halt. Whatever bulls had to buy is already done and bears too have covered their large part of shorts. Markets are expected to remain sideways and rangebound, unless some dramatic triggers turn the wheel either up or down," Jimeet Modi, Founder & CEO at SAMCO Securities & StockNote told Moneycontrol.

"India-Sino escalation may turn out to be a show spoiler, on which markets may react negatively in a sustained way. Further, continuous selling pressure from FPIs in the secondary market may not let the bulls take charge. There seems to be an absolute lock-jam and July 2020 is anticipated to be a boring month for both traders and investors," he added.

Here are 10 key factors that will keep traders busy this week:

Earnings

About 119 companies will announce their quarterly earnings this week. However, majority of them will be releasing their March quarter earnings as the Securities and Exchange Board of India (SEBI) had in June allowed companies to declare March quarter results till July 31 following on a request from corporates.

Only Tata Consultancy Services (TCS), South Indian Bank and Karnataka Bank will announce their June quarter earnings this week.

The rest, like IRCTC, NBCC India, Dish TV, Kokuyo Camlin, Bodal Chemicals, IFB Agro Industries, IFB Industries, Sadbhav Infrastructure Project, Suzlon Energy, Shree Renuka Sugars, Automotive Stampings & Assemblies, Swelect Energy Systems, Sadbhav Engineering, Ashapura Minechem and Future Consumer among others, will declare March quarter and full year FY20 earnings.

Tata Consultancy Services

The June quarter earnings season will begin on July 9 with TCS, the country's largest IT services provider.

The company is expected to see a 5.4-5.5 percent sequential decline in constant currency revenue with cross currency headwinds of 40-50 bps, hence the dollar revenue fall could be 5.9-6.0 percent QoQ due to the impact of coronavirus-triggered lockdowns across the world on travel, transportation, retail, auto, energy and manufacturing segments, though there was stability in financial and life sciences segments.

Brokerages expect 30-50 bps sequential decline in EBIT margin due to lower utilisation, weak operating leverage offset by rupee depreciation and lower travel expenses. Trends across verticals, pricing pressure, deal pipeline, long term trends in IT services spending, changes in delivery model, etc. will be key things to watch out for in the management commentary.

Coronavirus risk

The rising COVID-19 cases is a clear risk for the market. However, the market could be supported by the increasing rate of recovery. Plus, India's rural areas seem to have been less affected by the outbreak as compared to urban centres where a significant majority of the cases have been reported, experts feel.

India reported nearly 23,000 new COVID-19 cases on July 4, which was the highest single-day jump. Nearly 6.5 lakh cases have been reported in India so far, including more than 18,600 deaths. Yet, the recovery rate has been rising and currently stands at 60.8 percent.

Follow our LIVE blog for the latest updates of the novel coronavirus pandemic

Globally, there have been over 1.1 crore confirmed cases of COVID-19. More than 5.2 lakh people have died so far.

Hence, the market will be closely watching the rising number of COVID-19 cases and developments related to a potential vaccine.

Click here for Moneycontrol’s full coverage of the novel coronavirus pandemic

Indian Rupee

The Indian Rupee (INR) closed at over three-month high on July 3, appreciating by 95 paise to 74.64 against the United States Dollar (USD) during the week following risk on sentiment, rally in equity market, open market operations by the Reserve Bank of India (RBI), current account surplus in Q4FY20 for first time in more than 10 years, inflows through corporate deals, etc.

The currency gained 222 paise against USD, from its record closing low seen in April this year. The rupee also appreciated against the Euro, British Pound, etc.

Experts feel that INR may hold its support level of 74 against USD in the coming days, but if it breaks the same then the RBI may intervene.

"The bias for the rupee has shifted towards appreciation, given the risk-on environment and significant flows in the market, and as strong data sets from the US have weighed on the dollar. That should lead to the rupee testing levels of 74.30 and 74 eventually. Having said that, we believe the RBI will step in at regular intervals, and will not be comfortable to see the rupee appreciate beyond the 73.90 to 74.00 band," Sugandha Sachdeva VP-Metals, Energy & Currency Research at Religare Broking told Moneycontrol.

FII and DII flow

Foreign institutional investors (FIIs) were net sellers during last week, to the tune of Rs 5,333 crore following muted flow in previous week, which is a point of concern for the sustainability of market rally in coming weeks, though the rupee continued to appreciate against the US dollar, experts feel.

But, domestic institutional investors (DIIs) played a supportive role as they net bought Rs 5,041 crore worth of shares during the week. They were net sellers in the previous week.

Macro Data

Industrial production data for May will be released on July 10, while on same day, foreign exchange reserves for week ended July 3 will also be announced.

India's factory output measured by the index of industrial production (IIP) contracted by a record 55.5 percent in April (against contraction of 18.3 percent in March), which was not comparable with previous months due to complete lockdown during the month to contain the coronavirus spread. In May, the government allowed industries to work with less manpower only in non-containment zones.

Technical view

The Nifty50 continued uptrend for third consecutive session to close with half a percent and formed indecisive Doji kind of pattern on the daily charts Friday, though with a weekly gain of 2.2 percent it formed strong bullish candle on the weekly scale.

As the index already reached near its resistance levels and the banking index remained unsupportive for past few sessions, there could be some consolidation but the positive sentiment may remain as long as the index holds 10,500 levels, experts feel.

"The short term trend of Nifty continues to be positive. The choppy movement at the upside could continue in the early part of next week. The overhead resistance of 10,650-10,700 is expected to weigh high for the Nifty in next week. Hence, minor profit booking from the highs is likely. A sustainable move only above 10,700 could open up next upside targets of 11,000-11,200 in the next couple of weeks," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

F&O cues and volatility

The July series started off on a positive note with Nifty50 gaining more than 3 percent so far, from its June series closing of 10,288. There has been a consistent shift in lower-upper band of trading range on the higher side.

It indicates that bulls are having an upper hand and the index has to consolidate above June series closing levels, experts feel.

"The options data indicates that the maximum open interest on the Put side has shifted to 10,400 strike. We have also seen fresh Put writing at 10,500 strike which holds the second-highest open interest and also likely to act as a major support in the coming week," Nilesh Jain of Anand Rathi told Moneycontrol.

"A huge amount of Call writing was seen at 11,000 strike which also holds the maximum open interest followed by 10,600 strike. So the Nifty may trade in a broader range of 10,400-11,000," he said.

The fall in volatility also remained supportive and favourable for bulls. The India VIX declined by 10 percent to end at a 3-month low of 25.7 levels.

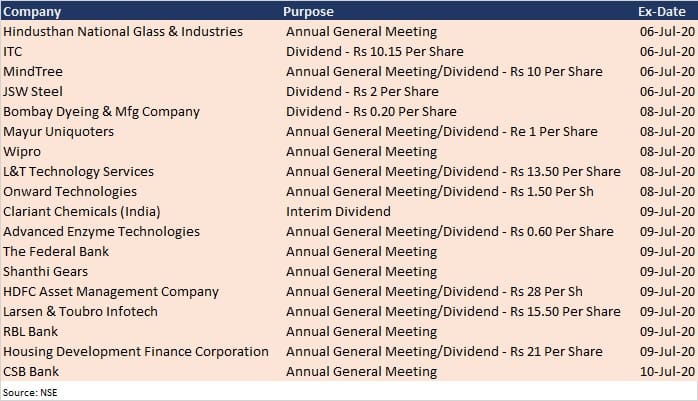

Corporate Action

Here are key corporate actions taking place this week:

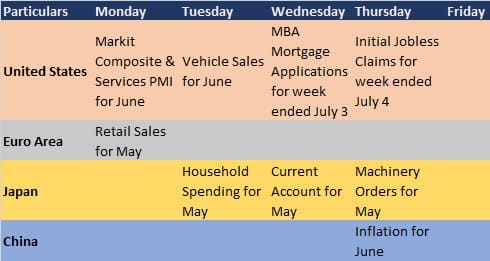

Global cues

Here are key global data points to watch out for this week:

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!