The market recovered sharply from March lows to rally over 31 percent but remained volatile in the hope of strong stimulus measures. But when the Rs 20-lakh-crore package was announced last week, it failed to cheer market, as the measures largely focussed on the supply side with a long- term view and didn’t do much to push demand.

As a result, the indices have plunged more than 10 percent from their recent highs. The recent acceleration in coronavirus infections have only added to the worries.

Unless the cases begin to fall and the lockdown ends, a rally is unlikely, say experts. The market will remain volatile though further measures from the government and the RBI could provide support but not a rally.

"We believe equity markets will remain volatile on announcements and behave in tandem with global trends until the pandemic reaches a manageable level," Prashanth Tapse, AVP Research at Mehta Equities told Moneycontrol.

“Equity markets environment is challenging and uncertainty is been played in markets, with difficulty of predicting what comes next a relief recovery or yet another volatile markets for the short term.”

One should be prepared that volatility will remain for some more time, he said.

Most experts advise buying quality stocks, saying once the pandemic is brought under control and lockdown ends, these shares will be the first to gain when the recovery begins.

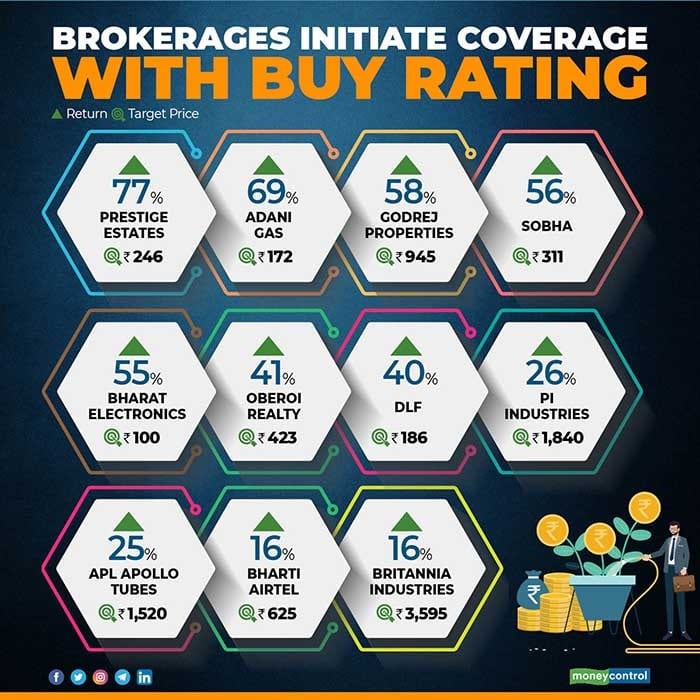

Here are top 11 stocks where brokerages initiated coverage with a buy rating in May and expect 16-77 percent return:

PI Industries: Buy | Target: Rs 1,840 | Return: 26 percent

A leading custom synthesis and manufacturing (CSM) player with an enviable domestic portfolio, PI Industries (PI) is a solid investment play for the next 18-24 months, given the carnage visible across industries due to the ongoing COVID-19 crisis, Centrum Broking says.

Considering R&D and complex chemistry capabilities, a robust order book, growing innovation capex by the leading global agrichem players and the additional delta from Isagro acquisition (completed in Q4FY20), PI looks set to deliver market-leading growth (EBITDA/PAT CAGR of 27.9/27.5 percent over FY20-22E) underpinning positive stance, it says.

Centrum initiated coverage with a "buy" rating and a target price of Rs 1,840 per share.

Bharat Electronics: Buy | Target: Rs 100 | Return: 55 percent

Bharat Electronics (BEL), a government-owned defence company, is a leader in electronics-based equipment to the army, air force and navy. BEL has a humongous order book of Rs 51,800 crore to be delivered over the next three-four years, which itself provides a robust outlook and visibility over long term, LKP Securities says.

The brokerage believes a cut in the defence budget may impact the receivables in FY21 in view of COVID-19 but BEL will be able to weather the storm. As announced recently, an increase in FDI limit to 74 percent from 49 percent may offer a positive surprise, it says.

LKP says the new margin norms may have a little impact as it believes BEL will offset this through faster localisation driven by large project sizes and a growing share of service revenues.

With FY21 expected to be a subdued year, FY22 will witness a bump-up in business due to deferment of execution and postponement of deliveries, says the brokerage.

It initiated a coverage on BEL with a "buy" and a target of Rs 100.

APL Apollo Tubes: Buy | Target: Rs 1,520 | Return: 25 percent

"APL Apollo Tubes' (APAT) revenue and earnings are likely to remain subdued in FY21, which we believe to pick up pace after the second half of FY21. Hence, we expect its revenue, EBITDA and net profit to clock 1/4/2.6 percent CAGR over FY20-FY23, as the company focuses to improve its operating efficiency," Reliance Securities says .

Further, the brokerage says APAT deserves premium valuation compared to peers on the back of lean working capital, low debt, and ready capacity.

"As per our analysis change in HRC prices has a very low correlation with APAT’s EBITDA. Hence, we have valued the stock on PE basis by assigning a multiple of 14x on FY23E EPS of Rs 108.6, arriving at a target price of Rs 1,520 and assign a buy rating on the stock," Reliance Securities say.

Adani Gas: Buy | Target: Rs 172 | Return: 70 percent

Monarch Networth Capital initiated coverage on Adani Gas (AGL), India's largest private sector pure-play city gas company, with a "buy" and target price of Rs 172 as the company offers an alluring combination of trailblazing volume growth on the back of PNGRB's round 9 & 10, and path-breaking efficiency levels as a result of prudent gas sourcing and higher CNG throughput/station.

The joint venture with Indian Oil is on its path to profitability, the brokerage says, adding given that regulatory tailwinds, operational excellence and volume spike can culminate in strong earnings, the investment by Total could be a game-changer, as it alters the image of the company to a quasi-MNC along with bringing synergies across gas sourcing, CNG business and fuel retailing.

COVID-19 will likely disrupt volumes but it will be a short-term 'spoilsport' in an overall long-term story, Monarch says.

Bharti Airtel: Buy | Target: Rs 625 | Return: 16 percent

Anand Rathi has initiated coverage on Bharti Airtel with a "buy" and a target price of Rs 625 per share.

"In recent quarters, the company has been witnessing growth in its average revenue per user (ARPU) in mobile services India. From Rs 104 in Q3FY19, ARPU has increased to Rs 135 in Q3FY20. ARPU should continue to improve given the increased tariffs effective December 2019," the brokerage says.

Further, revenue prospects look decent as the company has been able to record steady improvement in the performance of African operations (contributed around 30 percent of reported consolidated EBITDA in FY19) over the last few quarters on the back of growth in data and several strategic initiatives.

During FY20, the company has undertaken several efforts to deleverage its balance sheet including rights issue of Rs 25,000 crore and Airtel Africa IPO of around $670 million. Most recently in January 2020, the company raised Rs 21,501.7 crore through a combination of QIP and FCCBs.

"The intense competition in the domestic telecom industry has gradually lessened with reduced number of players. Given the current scenario, Bharti Airtel is likely to enjoy further market share as another key player -Vodafone Idea- struggles to survive," Anand Rathi says.

The company should also benefit from the deferral of spectrum auction instalment payments and moderation in capital expenditure intensity

(Note: Bharti Airtel reported a loss of Rs 5,237 crore in Q4FY20 and ARPU at Rs 154)

Britannia Industries: Buy | Target: Rs 3,595 | Return: 16 percent

Japanese brokerage house Nomura has initiated a buy call on the stock on likely margin expansion and market share gain.

The brokerage has set a target price at Rs 3,595, implying a 15 percent potential upside from current levels.

Britannia is likely to be least impacted by the consumption downturn and will benefit from a shift to in-home and packaged food consumption, Nomura says.

The company has a wide portfolio of new products and stronger direct reach.

Hence, it should gain market share and there will be gradual margin expansion, says Nomura, which expects FY19-22 earnings CAGR of 12.7 percent.

DLF: Buy | Target: Rs 186 | Return: 40 percent

Godrej Properties: Buy | Target: Rs 945 | Return: 58 percent

Oberoi Realty: Buy | Target: Rs 423 | Return: 41 percent

Prestige Estates: Buy | Target: Rs 246 | Return: 77 percentSobha: Buy | Target: Rs 311 | Return: 56 percent

Jefferies initiated coverage with a "buy" rating on these stocks under its coverage in the real-estate space. Godrej Properties is its top pick.

The brokerage advised buying DLF with target at Rs 186, Godrej Properties at Rs 945, Oberoi Realty at Rs 423, Prestige Estates at Rs 246 and Sobha with price target at Rs 311 per share.

Real-estate stocks were down 44-60 percent from their 2020 peak pricing in a 20 percent-plus capital value decline but the seven-year-long weak residential cycle set a good base to bounce back, Jefferies says.

Survivors are set to make disproportionate gains and consolidation will get a boost as disruption weeds out the weak hands, it says. Many companies have in the last several years either shut down or sold projects to other companies.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!