Hindustan Unilever, which hit a fresh 52-week high of Rs 1,603.60 per share, surpassed cigarette-to-soap major ITC in terms of market capitalisation in intraday trade on Friday to become the fourth largest valued company on the BSE and most valued firm in the FMCG space.

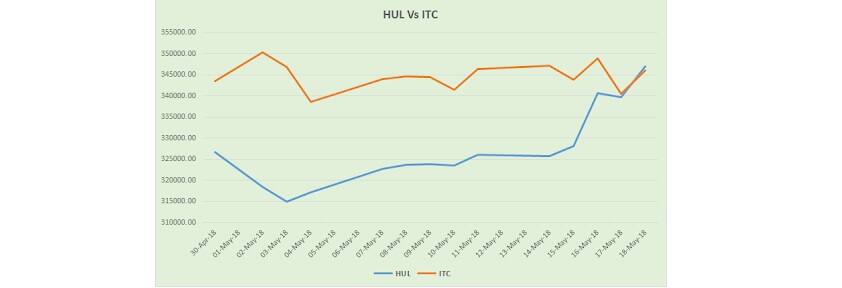

HUL’s MCap stood at Rs 347,103 crore when it touched its 52-week high on Friday, whereas ITC's MCap was Rs 346,052.78 crore at around the same time.

Outperformance by HUL helped the company surpass ITC. HUL has been gaining momentum, while ITC has merely held on to the same level where it was in the last one-year.

In the last one year, HUL rallied from Rs 1,006.35 per share recorded on May 17, 2017 to Rs 1,569.25 per share seen on May 17 this year, which translates in an upside of nearly 56 percent. On the other hand, ITC slipped to Rs 279 per share on May 17 from Rs 281.85 per share recorded on May 17, 2017. This translates in a fall of little over a percent.

Most global brokerage firms maintain a strong buy on HUL post its Q4 result. They have raised their target price for the FMCG major which translates in an upside of six percent. In the case of ITC, most global brokerage firms maintain their recommendation on the stock with a 12-month target price of Rs 340 per share.

Here’s what global brokerage firms are recommending on both ITC and HUL post Q4 results:

Global brokerage firms on HUL:

CLSA: Outperform| Target raise to Rs 1,650 from Rs 1,575

CLSA maintains an outperform rating on HUL post Q4 results but raised its target price to Rs 1,650 from Rs 1,575 earlier. Hindustan Unilever's 11 percent volume growth is best in class, said the CLSA note.

The management commentary is also fairly positive, with a decisive pick-up seen in the rural growth. “The rural segment has improved but we need to wait a few more quarters to establish any trend,” added the note.

Credit Suisse: Outperform| Target raise to Rs 1,675 from Rs 1,530 earlier

Credit Suisse maintains an outperform rating on HUL post Q4 results but raised its 12-month target price to Rs 1,675 from Rs 1,530 earlier.

HUL saw a strong pick-up in volume growth trend while margins expanded despite a jump in ad spend. The volume growth is at 11 percent mark which is a significant acceleration in the trend on the base of 4 percent, said the Credit Suisse note.

The management still looks to expand operating margins in FY19 despite the expectation of a rise in inflation led by higher crude oil prices.

Morgan Stanley: Underweight| Target raise to Rs 1,260 from Rs 1,120

Morgan Stanley maintains an underweight rating on HUL Post Q4 results but raised its 12-month target to Rs 1260, from Rs 1120 earlier.

The Q4 suggests worst in terms of volume growth for the industry, but worst may well be over. The brokerage firm estimate around 9 percent volume growth in FY19. HUL stocks trade at 30 percent premium to last 12-year average price to earnings ratio.

Global Brokerage firms on ITC:

Morgan Stanley: Overweight| Target: Rs 320

Morgan Stanley maintains an overweight stance on ITC post Q4 results with a target price of Rs 320. Cigarette volumes declined 2.5 percent which was broadly in line with estimates.

The key positive from the Q4 result was the cigarette EBIT growth which stood at 7.6 percent. Overweight rating is premised on the expectation of a steady cigarette tax policy, said the report.

CLSA: BUY| Target: Rs340

CLSA maintains a buy rating on ITC post Q4 results. The Q4 was in line with our expectation although other businesses were much weaker.

The Cigarette volumes declined around 3 percent on a YoY basis, a shade worse, highlighted the CLSA report. FY18 capex was around Rs33bn while the dividend payout was at less than 70 percent.

Jefferies: BUY| Target: Rs 330

Jefferies maintains a buy rating on ITC post Q4 results with a 12-month target price of Rs 330. The Q4 revenue, EBITDA, and PAT came broadly in line with our estimates.

There was a strong improvement in FMCG segment profitability. Jefferies expects FY19 to be a recovery year for the cig. business given likely lower tax hikes, it said in a report.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!