Traditionally, a majority of people invested in gold, real estate, bank FDs, but with increasing financial awareness more and more people have started looking at equity, bonds and mutual funds as an option for investment.

A big force behind investing in equity markets is to create wealth, but at the same time investors should also look at protecting capital when things head southwards.

In that case, diversification of portfolio comes in handy especially during COVID times where some amount of money should be allocated towards fixed income to safeguard capital in case volatility increases in equity markets.

Let's understand how one can diversify or make a portfolio with multiple products if he/she is the age group of 30-35 having a Rs 5 lakh in hand, though generally, experts feel one should always start investing as early as possible in the life.

But before going for any financial market product, experts advise that one should do risk profiling of himself/herself in order to understand the risk appetite & time horizon.

Their risk profiling includes various questions such as income per year, dependents in the family, the ultimate goal behind investments, etc.

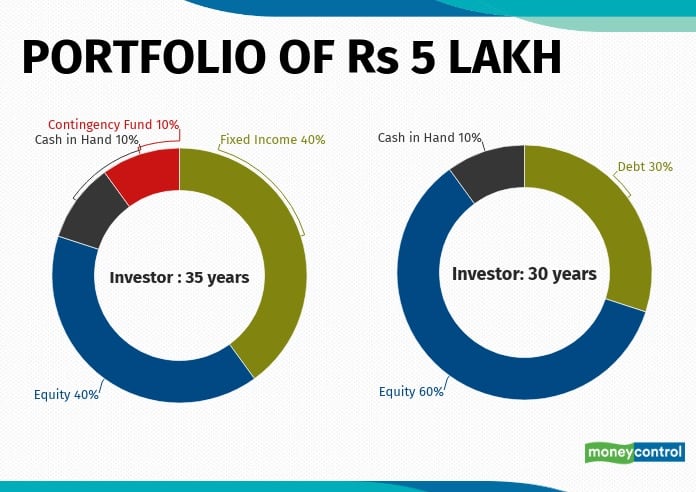

For an individual with an age of 35 years, Saurav Basu, Head of Wealth Management at Tata Capital advised that he/she should look at a medium risk portfolio where around 40 percent of his funds are invested in fixed income-generating securities like debt mutual funds for a long term, around 10 percent is cast aside as a contingency fund for emergencies.

"Further from the remaining 50 percent, a sum of around 10 percent should be left aside as cash in hand and the remaining 40 percent can be invested in the equity market for the long term, he said, adding this portfolio is strictly subject to the short term and long term goals of the individual and this individual should also ensure he/she owns a good quality insurance policy.

In the case of an individual with age of 30 years, Basu said since this individual is young and has quite a few earning years ahead, individuals can afford to have a little higher exposure.

"This individual should invest a little larger sum of money in high risk securities which generate higher profits. It should be noted here, that investments, even if high risk should be done after carefully studying the risk return ratio to avoid unnecessary financial losses," he added.

He advised that individuals should invest approximately 20-30 percent in debt products, around 50-60 percent in the equity in a staggered manner and the remaining should be set aside in the form of cash or fixed deposits for emergencies.

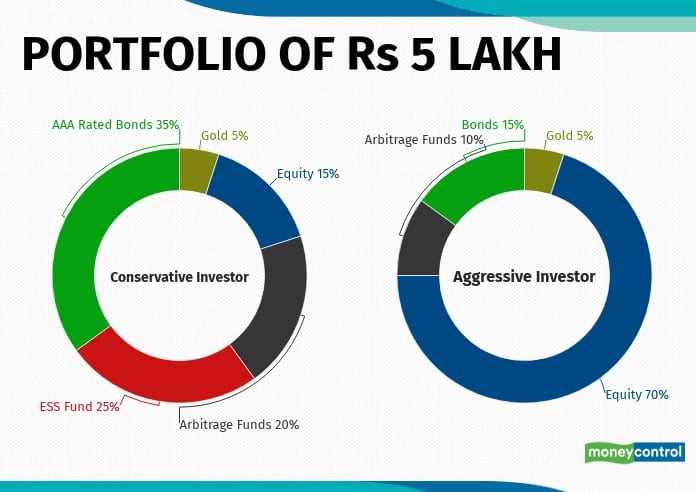

In the age 30-35, generally investors are aggressive enough to take some more risk as they have many years for retirement, so Amit Jain, Co-founder & CEO at Ashika Wealth Advisors advised that he/she can invest 70 percent in equity to gain advantage of emerging themes and attractive valuations in the current market scenario.

Amit Jain further said an individual can invest 5 percent in gold which is natural hedge against equity; 10 percent in Arbitrage Funds to provide for short-term needs & hedge against the equity markets in volatile scenarios; and balance 15 percent in bonds to provide a regular income.

But if an individual is a conservative investor, then Amit Jain said he/she should invest only 15 percent in equity, 20 percent in Arbitrage Funds; and 25 percent in ESS Fund - out of which 33 percent should be in equity, 33 percent in debt, 33 percent in arbitrage.

From the remaining, 35 percent investment should be done in AAA Rated Bonds or Sovereign Bonds or PSU Bonds where average yield to maturity is 7-8 percent, and the rest 5 percent in gold.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!