After six consecutive weeks of gains, bears made a comeback on Dalal Street in the week that ended on August 7. Both BSE Sensex and Nifty50 fell over a percent, dragged by banking & financials and oil & gas stocks but technology, pharma and metals stocks provided a cushion.

Weak global cues amid fear of US-China tensions, RBI'S warning of a potential rise in NPAs in FY21 and mixed earnings reports weighed on sentiment.

The profit-booking was warranted as the benchmark indices had rallied more than 12 percent in six weeks to hit more than a four-month high.

Going ahead, the market may see further consolidation with a negative bias as most of the positive news has already been discounted. With major corporate earnings out of the way, the street will now focus on RBI policy which could set the path for banking sector as moratorium will end in August, experts feel. Global cues will also be watched closely by the street.

"Markets seem to be in a consolidation mode with momentum slowing down in the last couple of sessions. This trend is expected to stay since the uncertainties continue and volatility remains high. Investors are advised to remain cautious and accumulate quality stocks in this uncertain environment," Vinod Nair, Head of Research at Geojit Financial Services told Moneycontrol.

Jimeet Modi, Founder & CEO Samco Group also advised investors to remain cautious and partly book profits. "They should wait for a sharp correction before making any fresh bets."

The broader markets outperformed benchmark indices last week as the BSE midcap and smallcap indices gained a fourth of a percent each.

Here are 10 key factors that will keep traders busy next week:

RBI Policy

In the coming week, all eyes will be on the three-day Monetary Policy Committee meeting which will conclude on August 6. Given the recent financial stability report wherein RBI warned of a sharp rise in NPAs in FY21 and current inflation scenario, experts expect the MPC members may cut repo rate by at least another 25 bps on top of 115 bps cut in previous two meetings.

Along with that, they also see more liquidity and regulatory measures from RBI to support the financial system and revive the economy.

"The recent high inflation readings have made the rate cut call a close one, however, we continue to see 25 bps of further easing in August followed by a pause. Besides policy rate cut, which in this environment may not be incrementally as effective, we expect the RBI would continue to provide the policy response required to address the demand shock and financial market dislocations through other liquidity and regulatory measures," Upasna Bhardwaj, Senior Economist at Kotak Mahindra Bank said.

RBI may look to widen the policy corridor to 75bps by easing reverse repo by a higher quantum, she added.

More than 300 companies will declare their June quarter earnings in the coming week which majorly included midcap and smallcap names.

Lupin, Mahindra & Mahindra, Cipla, HPCL, Dhanlaxmi Bank, Exide Industries, Kansai Nerolac Paints, KPIT Technologies, Astral Poly Technik, Dixon Technologies, Godrej Consumer Products, Gujarat Gas, Narayana Hrudayalaya, SPARC, Tata Consumer Products, Varun Beverages, Apollo Tyres, Cadila Healthcare, Canara Bank, DLF, Godrej Properties, Inox Leisure, JK Lakshmi Cement, Jyothy Labs, Strides Pharma Science, Adani Enterprises, Adani Power, BASF India, Blue Star, Gujarat State Petronet, Indian Hotels, JK Tyre, Pidilite Industries, Torrent Power, Alkem Laboratories, Amara Raja Batteries, Balrampur Chini Mills, Bata India, Emami, Finolex Industries, Mahanagar Gas, Siemens, Sobha, Affle (India), DCB Bank, Divis Labs etc will report quarterly results next week.

Auto Sales Impact

On Monday, auto stocks will react to July sales performance reported over the weekend. Sales announced so far by Maruti Suzuki and Mahindra & Mahindra were ahead of analysts' estimates.

Sales by Eicher Motors (Royal Enfield down 26 percent YoY at 40,334 units, and VECV down 46 percent YoY at 2,184) and Hero Motocorp (down 4 percent YoY at 5.14 lakh units) were more or less in line with analysts' estimates.

Coronavirus

India's COVID-19 tally of cases went past 17 lakh on Saturday evening, of which 11.1 lakh were reported in July alone thus accounting for about 65.48 percent of the total instances of the viral infection reported in the country so far. Experts feel we still may not be at the peak just yet.

Majority of experts globally feel the vaccine is expected to take more time for finalisation, though report suggested that top three-four companies are in phase 3 where the vaccine is given to thousands of patients.

Meanwhile, given the rising cases, especially in the US, the global recovery is expected to take longer than anticipated, though global central banks are pumping in trillions of dollars into economies to get back from the crisis, experts feel.

Mindspace REIT Listing

Mindspace Business Parks REIT successfully closed its Rs 4,500-crore public issue with nearly 13 times subscription on July 29. The price band was Rs 274-275 per share.

The listing of units is likely to take place in the later part of next week and the final issue price is expected to be at Rs 275 per share.

Technical View

The Nifty50 shed 28.70 points on Friday and lost 1 percent for the week to close at 11,073.50. It formed a bearish candle on daily as well as weekly charts.

Experts feel psychological 11,000 mark is expected to be immediate crucial support, followed by 200-DMA around 10,870 levels. According to them, if the index breaks 200-DMA in the coming week, there could be further selling pressure in the coming weeks and more or less the month of August is expected to be a rangebound one.

"We reiterate a cautious view on the market and suggest keeping the leveraged positions hedged. Nifty couldn't surpass the hurdle at 11,350 seen last week while the downside also remained capped. Going ahead, we feel it may continue to hover within 10,950-11,350 zone and either side break would trigger the further directional move. Meanwhile, traders should focus on stock selection and managing overnight risk," Ajit Mishra, VP Research at Religare Broking told Moneycontrol.

F&O Cues

The weekly options data indicates that the maximum open interest on the Put side is placed at 11,000 strike, which holds the open interest of 20.6 lakh contracts and also likely to act as a major support in the coming week. The maximum open interest on the Call side is placed at 11,500 strike followed by 11,200 and 11,300 strike, which is expected to be resistance points for the Nifty.

A huge amount of Call writing was seen at 11,200 strike which also holds the maximum open interest followed by 11,500 strike. So, the overall option data indicates some rangebound move in the coming week and Nifty may trade in a narrow range of 11,000-11,200, experts feel.

"The Nifty has entered into some consolidation after a sharp move was seen in the last few weeks. The index is likely to consolidate around 11,000. The highest Put base for this series is placed at 11,000 strike followed by 10,800 strike. Thus, positional support remains at 10,800 if any divergence is increased below 11,000 in the current consolidation," said Amit Gupta of ICICI Direct who expects more stock-specific moves to attract market participants amid rangebound market movement.

The volatility index India VIX is hovering below 25 levels from the past couple of weeks which hints of no major movement in the short term.

Macro Data

Markit Manufacturing and Services PMI for July will be released on August 3 and August 5 respectively, while foreign exchange reserves for week ended July 3 will be released on August 7.

Indian services sector activity contracted for the fourth consecutive month in June, coming in at 33.7 against 12.6 reported in May as business operations affected by COVID-19 pandemic, and manufacturing (factory) activity contracted for the third consecutive month in June, which was at 47.2 against 30.8 in May as demand and output was hit by the lockdown. Generally, the figure below 50 denotes a contraction and above 50 means expansion.

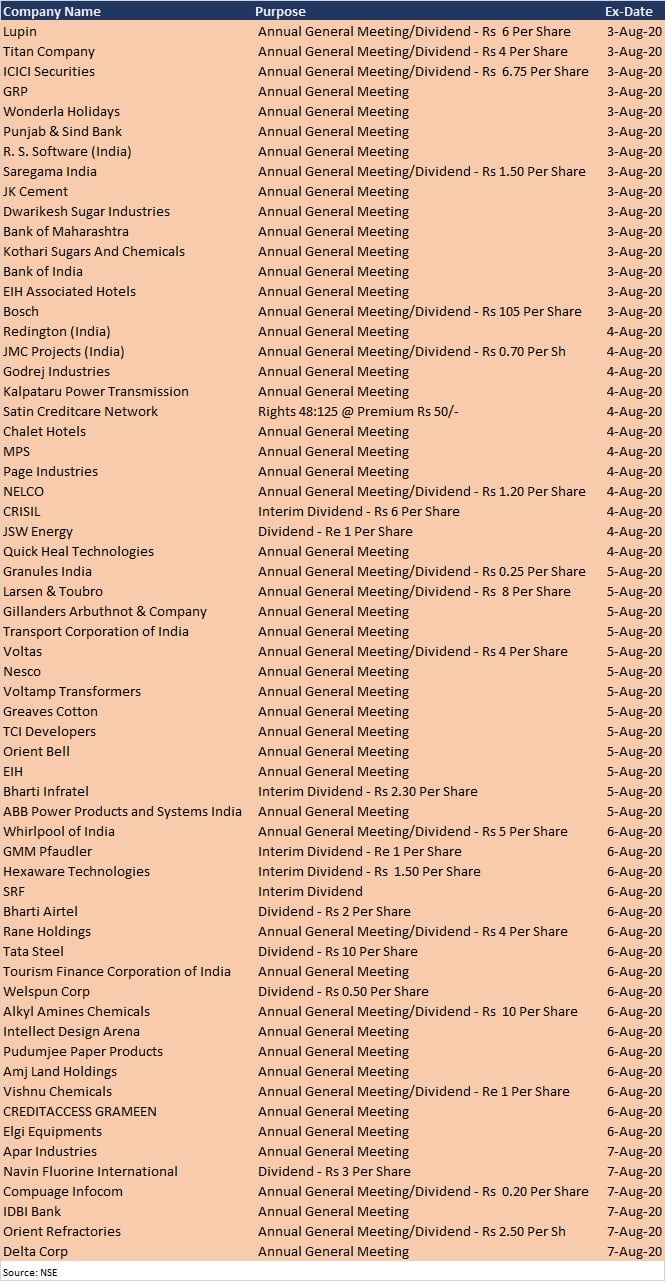

Corporate Action

Here are key corporate actions taking place in the coming week:

Meanwhile, the Rs 80-crore rights issue of Spencer's Retail will open on August 4 and close on August 18, while simultaneously the trading in Rights Entitlement will also take place during the subscription period. The issue price has been fixed at 75 per share and rights entitlement ratio is two rights equity shares for every 15 shares held by eligible shareholders.

Global Cues

Here are key global data points to watch out for next week:

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!