Bulls managed to reclaim some of the lost glory as Nifty50 gained around 10,000 while the S&P BSE Sensex also managed to reclaim 34000, but it could be termed as catch-up rally as the correction was quite significant and valuations for these sectors have become quite attractive.

Sustenance of rally in defensive sectors depends on visibility of factors like sustained improvement in global stocks, or the government capital spending picking up, Axis Securities said in a report.

The pharma sector has been the best performing sector since the onset of the COVID-19 crisis. The FMCG sector has also performed quite well during this period in terms of capital protection.

“We find both the sectors attractive from long-term value creation. Valuations is also attractive in the BFSI segment but moratorium extension poses challenges. The BFSI sector valuations have come down significantly as the sector has de-rated on expectations of significant COVID-19 related NPAs,” said the note.

The BFSI sector now actually offers good contra plays across the sector as there are high-quality companies with solid liquidity ratios available at cheap valuations.

“The extension of moratorium by the RBI poses challenges across the sector. Nonetheless, there is a case to gradually increase portfolio weight in the forthcoming months accumulating high-quality private banks,” it said.

Earnings remain an overhang:

The earnings season to date with a significant number of companies yet to declare results has been tepid with more negative surprises.

The brokerage firm is of the view that most companies have seen earnings downgrades and commentary has been cautious across sectors. However, some green shoots like the rural economy and agriculture-focused plays are indicating improving prospects.

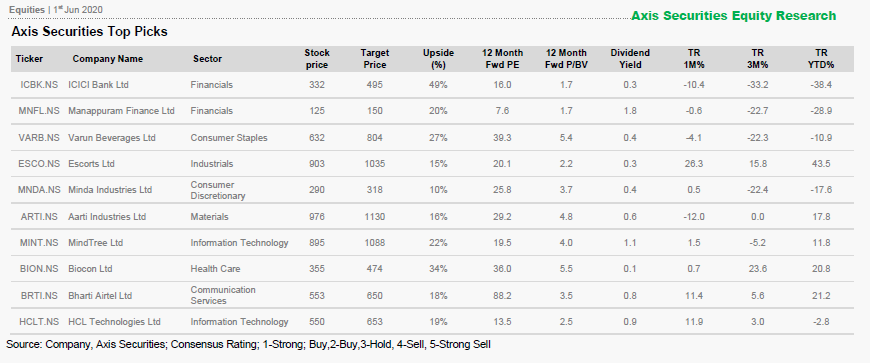

Here is a list of top 10 stocks that could deliver double-digit returns in the next 12 months:

Its subsidiaries ICICI Venture Funds, ICICI Pru AMC, ICICI Securities, ICICI Prudential and ICICI Lombard are amongst the leading companies in their respective segments.

“We expect higher provisioning over FY21/22E cushioned by stable NIM, low cost of funds and healthy capital adequacy. We believe valuations are undemanding for the stock given strong liability franchise and leveraging opportunities across group products,” said the report.

Mannapuram Finance: Target Rs 150

Manappuram Finance (MGFL) is amongst the leading gold loan NBFCs in India and is well diversified into other business segments like housing loan, vehicle loan, and microfinance, with a branch network size of around 4,623 spread across the country.

“We expect moderate loan growth and higher provisioning over FY21/22E cushioned by improvement in cost ratios. There will be pressure on the non- gold portfolio as it is less seasoned,” said the report.

However, gold lending will remain an attractive option for customers looking for credit as banks will be more risk-averse. Axis Securities expects MGFL to maintain ROAE of ~24% over FY21/FY22.

Varun Beverages: Target Rs 804

Varun Beverages (VBL) is the 2nd largest franchisee for PepsiCo in the world (outside USA). Products manufactured by VBL include Carbonated Soft Drinks - Pepsi, Mountain Dew, Seven Up, Mirinda; Non-Carbonated Beverages - Tropicana Slice, Tropicana Frutz; and Bottled water – Aquafina.

It operates in India and is also the exclusive bottler for PepsiCo in Nepal, Sri Lanka, Morocco, Zambia and Zimbabwe.

Axis Securities expects VBL to register Revenues/Earnings CAGR of 10%/28% respectively over CY19-21E. This growth will be driven by 1) consolidation in newly acquired territories, 2) distribution led market share gains, 3) cost efficiencies and 4) margin tailwinds.

Escorts Ltd is the 4th largest manufacturer of tractors in India with a presence in three business segments, i.e. agri-machinery (EAM), construction equipment (ECE), and railway equipment division (RED).

It has a strong presence in north and central regions and in 31-50HP (Horse Power) in the agri-machinery business. The company has gained market share and improved EBITDA margins significantly in Q4FY20.

"We expect annual revenue to grow by 7 percent YoY and 13 percent YoY in FY21E and FY22E, respectively. EPS is expected to grow at 2 percent YoY and 16 percent YoY for FY21E and FY22E, respectively," said the note.

Minda Industries: Target Rs 318

Minda Industries (MNDA) is the largest supplier of switches, acoustics and alloy wheels (PV segment) and is a top 2 player in lighting and safety air-bags in the automotive Industry.

MNDA has 62 manufacturing plants and 8 R&D centres across the globe. Group is headquartered in Manesar, Haryana, India.

"We expect annual revenue to grow at14.5% CAGR over FY20E-22E. Expect EPS to grow robustly at 35% y/y and 32% y/y for FY21E and FY22E,” said the note.

The company trades at 23.8x FY22E P/E multiples and will continue to command premium valuation due to an unmatched product offering among auto ancillaries and long history of superior growth.

Aarti Industries: Target Rs 1130

Aarti Industries Ltd. (AARTO) is the largest producer of Benzene based basic and intermediate chemicals in India. AARTO is a preferred partner of choice for +1000 customers globally.

"While, FY21E earnings would be impacted by COVID-19, we expect Aarti to report Revenues decline of 0.9% in FY21E and 24% growth in FY22E. Lower crude prices could partially offset the weak operating leverage thereby help protect Op. Margins in the near term," said the note.

As a result, Axis Securities expect Aarti to report earnings de-growth of 2.7 percent in FY21E and a growth of 36 percent in FY22E on the back of a strong recovery in volumes. It expects a strong improvement in FY22E ROE to 19 percent from a dip in FY21E owing to COVID-19 impact on the overall business.

Mindtree Ltd (MTCL.IN) is an Indian IT services company headquartered in Banglore. Mindtree provides specialized IT solutions, ER&D services to various industries like Hi-Tech, Manufacturing, BFSI, Travel and Hospitality. Mindtree also specialized in providing digital transformation services and solutions.

"We expect annual revenue to grow by 11% y/y and 11% y/y in FY21E and FY22E, respectively. EPS is expected to grow at healthy 16% y/y and 15% y/y for FY21E and FY22E, respectively," said the note.

Biocon has created a niche in the business of custom research in pharmaceuticals space; it operates in four broad business verticals, viz., small molecules & generic formulations, research services, biologics and branded formulations, each contributing 32%, 32%, 24% and 12% of revenues respectively.

"We expect annual revenue to grow by 25% CAGR over FY20-22E, EBIDTA to expand by 35% CAGR and PAT by 47% CAGR over the same period. The EBIDTA margins are expected to expand from ~27% in FY20 to 29% by FY22E driven by increased contribution from high margin Biologics segment," said the note.

Bharti Airtel is one of the largest telecom companies in the world with operations spanning 18 countries and a subscriber base of more than 420 mn subscribers.

It is the second-largest wireless telecom operator in terms of revenue after Reliance Jio. Bharti Airtel is a well-capitalized telecom operators with offerings across the telecom spectrum of enterprise and fixed-line broadband services.

"We value the company based on SOTP valuation at Rs 650. The value could increase by a further Rs 40/share if Vodafone-Idea shuts down. Our SOTP valuation implies an EV/EBIDTA of 9.5x on FY22E EBIDTA," said the note.

HCL Technologies: Target Rs 653

HCL Technologies Limited, an Indian Information technology (IT) service and consulting company headquartered in Noida, UP is a next-generation global technology company that helps enterprises reimagine their businesses for the digital age.

HCL technologies products, services, and engineering are built on strong innovation making a more sustainable business model even in uncertainties

"We believe HCLT has a resilient business structure from a long term perspective. The recent deal trend continues to be healthy for HCL tech and is reflective of traction in Retail & CPG, Manufacturing and BFSI verticals. HCL Tech has received various digital transformational deals worth more than $2.4bn in Q3 FY20," said the report.

Axis Securities is of the view that the COVID outbreak will create huge opportunities across geographies for HCL Tech to post strong organic growth over different verticals.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!