Neha DaveMoneycontrol research

India is the fastest growing market for paper globally and is expected to grow above six percent per annum over the next few years. The estimated domestic turnover of about Rs 50,000 crore at present accounts for about three percent of the world’s paper production. This presents an exciting scenario as paper consumption is poised for a big leap forward in sync with economic growth.

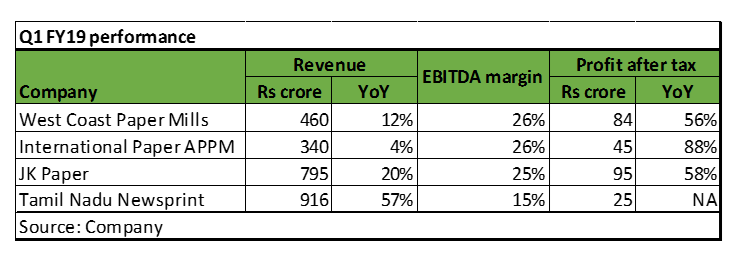

Writing and printing paper companies turned around sharply in FY17. The momentum continues in Q1 FY19 as well. Domestic demand remained buoyant, while the closure of stressed domestic capacities has led to supply constraints. Reduced raw material and power prices, which forms nearly 80 percent of operating cost, have aided profit growth.

Let’s look at paper companies which have seen a noticeable performance in their quarterly earnings.

West Coast Paper MillsWest Coast Paper Mills (WCP), a flagship company of the SK Bangur Group, has a single plant with an integrated capacity of 320,000 tonne per annum (writing and printing paper: 262,500 TPA; paperboard: 57,500 TPA). The company manufactures optical fibre cables and owns wind mills.

Its financial performance has improved significantly during the last two fiscals and the same trend continued in Q1 FY19 as well, with net profit surging 56 percent year-on-year and earnings before interest, tax, depreciation and amortisation (EBITDA) margin at 26 percent. However, there are some concerns. First, it imports around 40-50 percent of its input requirement. Though proximity to the Goa port gives it an edge over other mills located in interiors, profitability remains vulnerable due to global price movements and exchange rates. Second, attempt to acquire Sirpur Paper Mills through National Company Law Tribunal (NCLT) was unsuccessful as there was a default in one of the group companies. Hence, it has relied on organic growth.

International Paper APPMIncorporated in 1964, International Paper APPM (formerly known as The Andhra Pradesh Paper Mills) has more than five decades of experience in the Indian paper industry. IPAPPM produces writing, printing and copier papers for foreign and domestic markets. The company’s production facilities at Rajahmundry and Kadiyam (including a recycle unit) have a total installed capacity of 241,000 TPA

In a first, significant domestic acquisition by a foreign paper company, International Paper, bought 75 percent stake following which the company was renamed to IPAPPM. The US headquartered company is the largest pulp and paper company in the world with a presence across 24 countries.

IPAPPM reported better operating performance for Q1 FY19, while revenue registered a growth of only 4 percent YoY. EBITDA margin improved significantly to 26 percent. Consequently, profit grew a healthy 88 percent YoY. IPAPPM derives revenue from sale of both paper and pulp and de-risked its business by being an integrated manufacturer. The company’s ability to leverage brand, global presence and technology of the parent will be a key monitorable.

Tamil Nadu NewsprintTNPL, 35.32 percent owned by the Tamil Nadu government, has a production capacity of 600,000 TPA. Its plant at Kagithapuram in Tamil Nadu is the largest single location paper plant in India. It uses bagasse as the principal fibre source. Though the company has manufacturing capability for newsprint too, owing to unfavourable economics of manufacturing newsprint in India, its current production consists mainly of writing and printing paper.

Due to lack of adequate water, operations at TNPL's Karur plant was affected and led to it reporting a loss in Q1 FY18. Production volume declined about 50 percent, resulting in a sharp fall in revenue and profitability. Operating margin fell to 6.2 percent in Q1 FY18 as compared to 23.8 percent YoY due to lower production and higher pulp cost, as it had to import the latter at a higher rate.

The water situation has improved subsequently and the company resumed operations from July last year. As a result, the company is back in the green and reported strong revenue growth in Q1 FY19. There is scope for significant improvement as margin are still sub-optimal. We expect writing and printing paper capacity utilisation to improve to over 80 percent and the profitability to recover gradually as EBITDA margin reverts to previous levels of 20-22 percent from next fiscal.

Ability to secure inputs and increase in capacity will determine future profitabilityThe paper industry is characterised by cyclicality on account of input price volatility and capital expenditure plans. The last two years have been favourable as input pressures have eased out, while demand held up well.

Operating margin of paper companies was in the 13-14 percent range over FY12-15. Margin expanded by about 350 bps to 17 percent at the end of FY17 and is currently more than 20 percent. As per Crisil, writing and paper companies are expected to hold onto their healthy operating margin.

Going forward, the integrated player with sufficiency in all major inputs – raw material, water and power - will be able to sustain and improve margin. From the companies discussed above, JK Paper stands out as it sources more than 80 percent of its wood requirements from captive farm forestry. Adequate water is available at both units: Gujarat and Odisha. It has also achieved self-sufficiency in power with 80 MW capacity. Read : JK Paper: Well positioned in a sector on an upturn

West Coast Paper relies on imports to a large extent, which exposes it to volatility in input prices. TNPL is facing some shortage in sourcing of bagasse and is dependent on government auctions for its wood requirements. Water availability has been an issue for TNPL in the past.

All paper companies discussed above are operating at close to full capacity, except TNPL. JK Paper, with the acquisition of Sirpur Paper Mills, can increase production. West Coast Paper Mills is constrained for inorganic growth through the NCLT route. TNPL has set up a new board plant near Trichy with an annual capacity of 200,000 TPA, which commenced production in May 2016. There is ample scope to improve capacity utilisation in its writing and printing paper plant, now that water availability is not an issue.

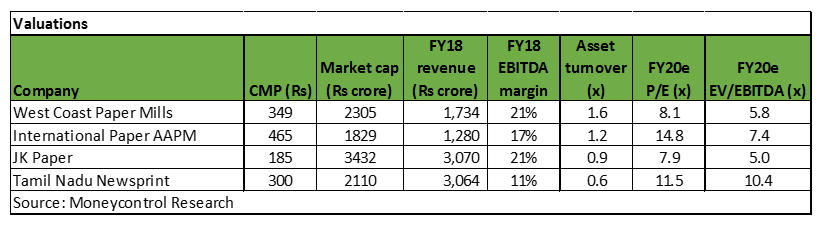

Valuation

Outlook for the paper sector in general and printing and writing companies in particular is positive. As per Crisil, over the next two years, writing and paper companies are expected to hold onto their healthy operating margin and generate an operating profit, which will be 33 percent higher than the last five year average.

Paper stocks have outperformed on the back of improving financials and strong earnings growth. While valuation re-rating for many paper companies seems to have played out, sectoral opportunities provide strong earnings visibility. As a result, valuation will be sustained.

TNPL is the stock to watch out for. While the delta in earnings can be huge, we would like to watch the pace of margin improvement and ramping up of production at the commissioned board plant for at least a quarter to decisively turn positive on the stock. Within the sector, we continue to prefer JK Paper. The stock is currently trading at 5 times FY20e enterprise value-to-EBITDA, which is reasonable considering the high earnings growth potential.

For more research articles, visit our Moneycontrol Research page

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!