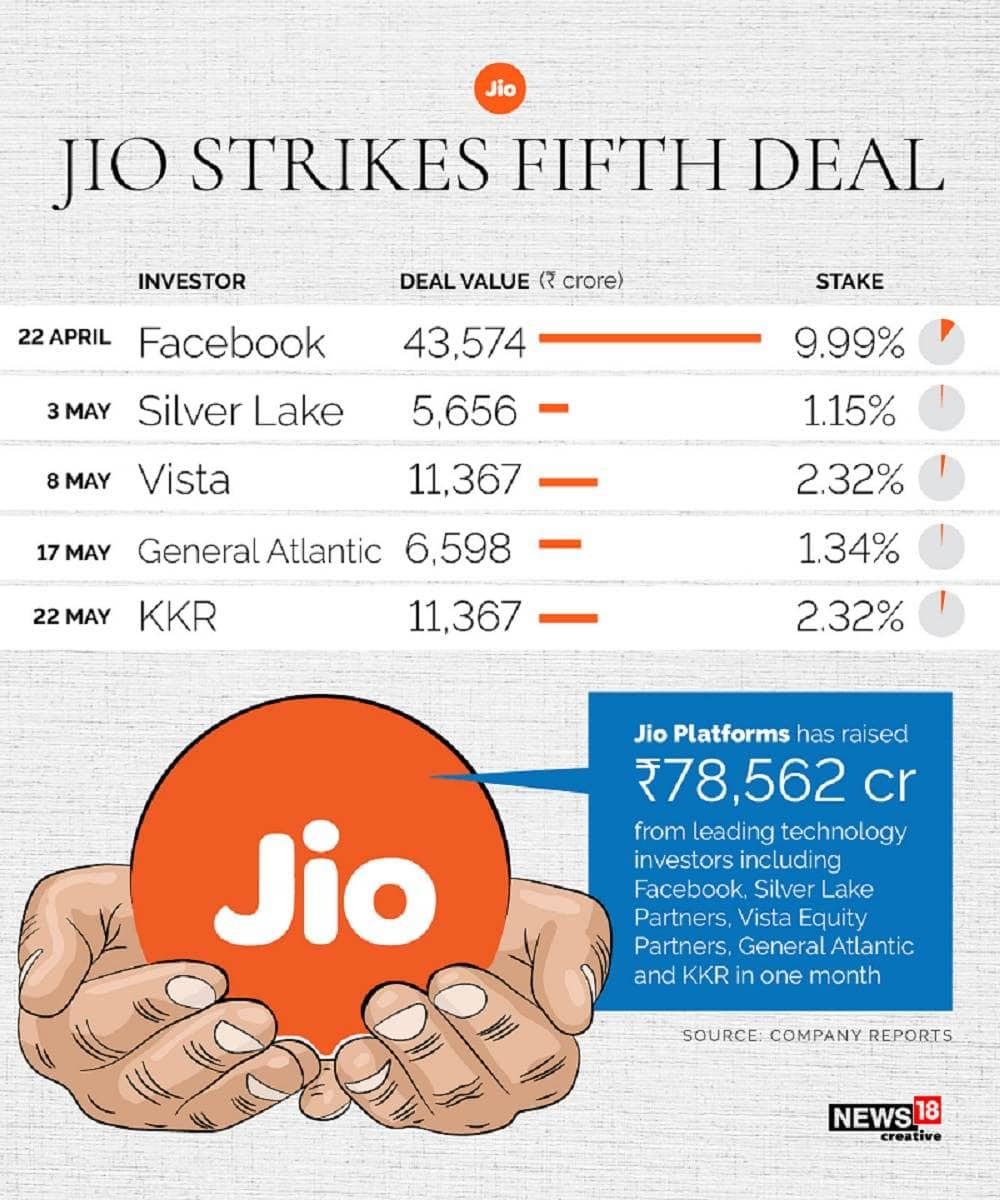

Reliance Industries on May 22 said KKR will invest Rs 11,367 crore for 2.32% stake in Jio Platforms. This is the fifth big-ticket deal announced by the oil-retail-to-telecom conglomerate in the past month.

This transaction values Jio Platforms at an equity value of Rs 4.91 lakh crore and an enterprise value of Rs 5.16 lakh crore. This is KKR’s largest investment in Asia and will translate into a 2.32% equity stake in Jio Platforms on a fully diluted basis.

Over the last month, leading technology investors, such as, Facebook, Silver Lake, Vista, General Atlantic and KKR have announced aggregate investments of Rs 78,562 crore into Jio Platforms.

The deals are all part of the plan to make the company net debt-free before March 31, 2021.

Mukesh Ambani, Chairman and Managing Director of Reliance Industries, said, “I am delighted to welcome KKR, one of the world’s most respected financial investors, as a valued partner in our onward march to growing and transforming the Indian digital ecosystem for the benefit of all Indians. KKR shares our ambitious goal of building a premier Digital Society in India. KKR has a proven track record of being a valuable partner to industry-leading franchises and has been committed to India for many years. We are looking forward to leveraging KKR’s global platform, industry knowledge and operational expertise to further grow Jio.”

Also Read: KKR-Jio Platforms deal: 5 key things to know

KKR is making the investment from its Asia private equity and growth technology funds.

Henry Kravis, Co-Founder and Co-CEO of KKR, said, “Few companies have the potential to transform a country’s digital ecosystem in the way that Jio Platforms is doing in India, and potentially worldwide. Jio Platforms is a true homegrown next generation technology leader in India that is unmatched in its ability to deliver technology solutions and services to a country that is experiencing a digital revolution. We are investing behind Jio Platforms’ impressive momentum, world-class innovation and strong leadership team, and we view this landmark investment as a strong indicator of KKR’s commitment to supporting leading technology companies in India and Asia Pacific.”

Also Read: KKR-Jio Platforms deal: All you need to know about the US-based private equity firm

Morgan Stanley is the financial advisor to Reliance Industries, and AZB & Partners and Davis Polk & Wardwell acted as legal counsel.

Deloitte Touche Tohmatsu India is the financial advisor to KKR. Shardul Amarchand Mangaldas & Co. and Simpson Thacher & Bartlett LLP are legal counsel to KKR.

Read all KKR Jio deal stories here

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!