Abu Dhabi sovereign fund Mubadala Investment Company will inject Rs 9,093.6 crore in Jio Platforms in exchange for 1.85 percent, the sixth investment in the RIL digital unit in as many weeks and underscoring its standing as an irresistible lodestar for some of the world’s biggest tech companies and investors.

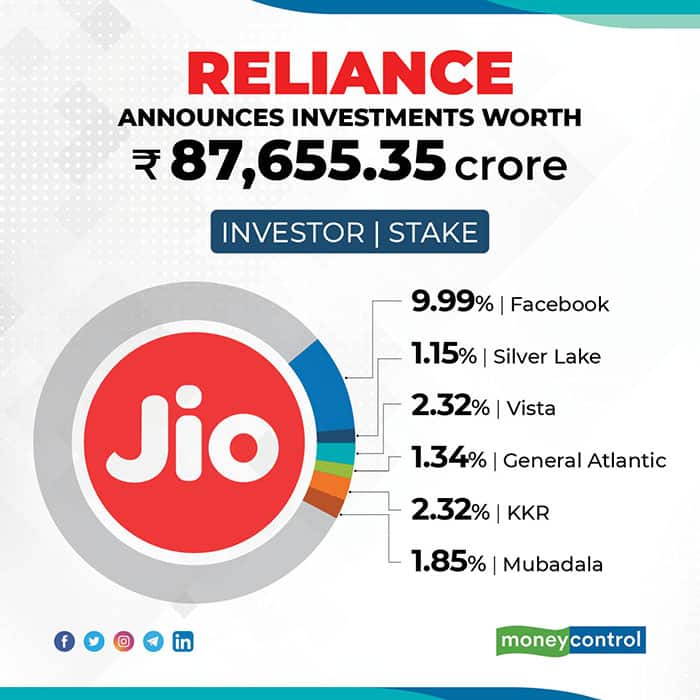

The investment by Mubadala, which manages about $229 billion in assets, at an equity value of Rs 4.91 lakh crore and an enterprise value of Rs 5.16 lakh crore takes the total amount raised by Jio to an eye-popping Rs 87,655.35 crore, according to a statement by RIL.

Jio Platforms, which runs movie, news and music apps as well as the telecom enterprise Jio Infocomm, has now sold a combined stake of 18.97 percent in six massive fundraising deals.

The series of deals was led by Facebook Inc, which invested Rs 43,574 crore to buy 9.99 percent on April 22. Since then, General Atlantic, Silver Lake, Vista Equity Partners and KKR together spent Rs 78,562 crore on Jio.

Mukesh Ambani, chairman and managing director of Reliance Industries (RIL), said he was delighted that Mubadala, one of the most astute and transformational global growth investors, has decided to partner his company in its journey to propel India’s digital growth towards becoming a leading digyal nation in the world. “Through my longstanding ties with Abu Dhabi, I have personally seen the impact of Mubadala’s work in diversifying and globally connecting the UAE’s knowledge-based economy. We look forward to benefitting from Mubadala’s experience and insights from supporting growth journeys across the world,” he said in a statement.

The deals underline the status of Jio Platforms as a tech powerhouse and its ability to dominate India’s booming digital economy. Jio Platforms has made significant investments across its digital ecosystem, powered by leading technologies spanning broadband connectivity, smart devices, cloud and edge computing, big data analytics, artificial intelligence, Internet of Things, augmented and mixed reality and blockchain.

Jio Infocomm is India’s biggest telecom player, amassing more than 388 million subscribers since its launch in late 2016.

Khaldoon Al Mubarak, managing director and group CEO, Mubadala Investment Company, said his company is committed to investing in, and actively working with, high-growth companies that are pioneering technologies to address critical challenges and unlock new opportunities. “We have seen how Jio has already transformed communications and connectivity in India, and as an investor and partner, we are committed to supporting India's digital growth journey. With Jio’s network of investors and partners, we believe that the platform company will further the development of the digital economy."

Mubadala is billed as the second-biggest state investor after Abu Dhabi Investment Authority. It has more than 50 businesses and investments in more than 50 countries.

Mubadala typically makes investments in enterprises that create lasting value and positive economic and social impact in communities at home and overseas, according to its website. Its portfolio companies are spread in sectors such as aerospace, agribusiness, ICT, semiconductors, metals and mining, pharmaceutical and medical technology, renewable energy and utilities. It also manages diverse financial holdings.

The transaction is subject to regulatory and other customary approvals.

Morgan Stanley acted as financial advisor to Reliance Industries and AZB & Partners, and Davis Polk & Wardwell acted as legal counsel.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!